Finding, Measuring, and Maintaining Product-Market Fit for a SaaS Startup

The primary reason for startups’ failures is that there was no significant market need for their product or service. The marketing term that reflects this concern is known as product-market fit (PMF).

Finding a product-market fit is a crucial early-stage challenge for every startup and the first point of real success in their product development process. If they build their product before they’ve found a market for it, they may need to burn up lots of cash on improvements before it meets the market’s requirements. If startup founders decide to scale up without proven PMF, they are taking the risk of prematurely shifting capital away from product development to hiring or marketing that will generate no return.

It reportedly takes 2-3 times longer to validate the market than most founders expect. If a startup fails to achieve PMF within the first two or three years, it is usually forced to pivot or shut down. If it succeeds, the evolving market and technology may still undermine its position soon, so measuring PMF becomes an ongoing necessity like periodic health checks.

Continuing our blog series on software-as-a-service (SaaS) startups, we would like to dedicate this one to the role of product-market fit in their life-cycle. Here, you may find some tips on finding and measuring PMF and developing a SaaS that the market truly needs.

The Significance of Product-Market Fit for SaaS Startups

What is product-market fit exactly? The concept was developed by Andy Rachleff, a co-founder of Wealthfront and Benchmark:

“A value hypothesis is an attempt to articulate the key assumption that underlies why a customer is likely to use your product. […] Identifying a compelling value hypothesis is what I call finding product/market fit. A value hypothesis addresses both the features and business model required to entice a customer to buy your product.”

For Eric Ries, author of ‘The Lean Startup,’ the product-market fit is “the moment when a startup finally finds a widespread set of customers that resonate with its product.”

Marc Andreesen of Andreesen Horowitz understands PMF as “being in a good market with a product that can satisfy that market.” A good market generally means an expanding market. Entrepreneurs need to assess both a specific market’s (e.g., medical CRM solutions) ability to sustain their business and their product’s ability to meet that market’s needs.

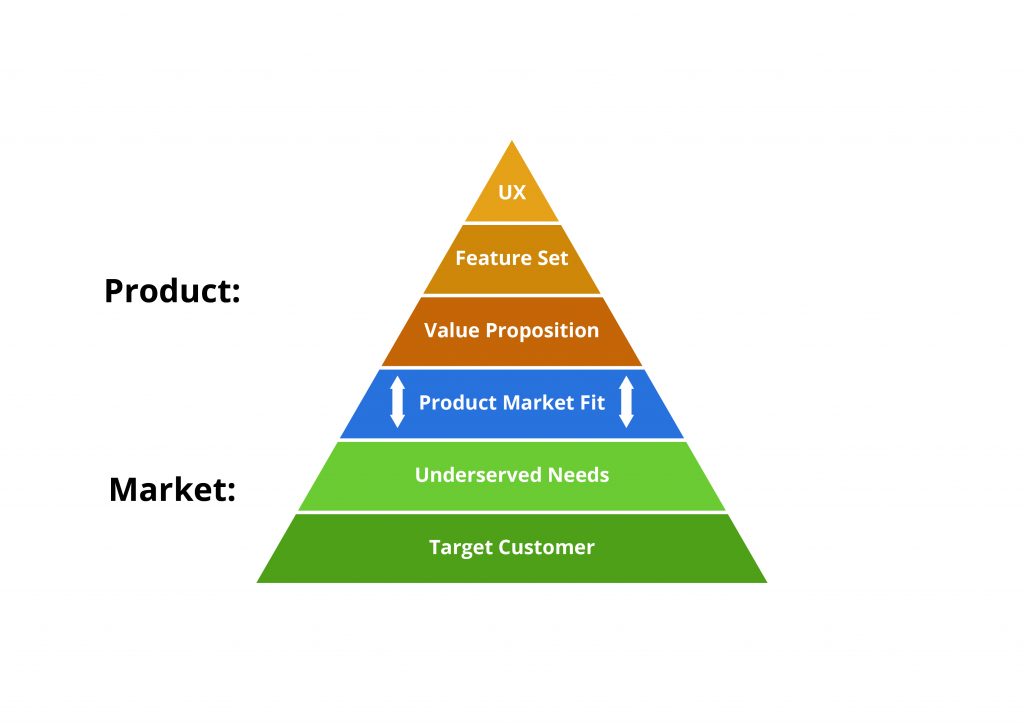

Dan Olsen, author of ‘The Lean Product Playbook,’ believes that PMF means that a product not only meets real customer needs but also “does so in a way that is better than the alternatives.”

Image source

Josh Porter of Bokardo.com pointed to another important factor: “Product-market fit is when people sell for you.” This means that customers need to be so engaged and loyal to a product that they will become its voluntary promoters.

To sum up, product-market fit describes a moment where a startup has identified a broad group of target customers and provides them with the right product. The right product is one that customers want, eagerly pay for, and promote because it solves their burning problem and surpasses the alternatives.

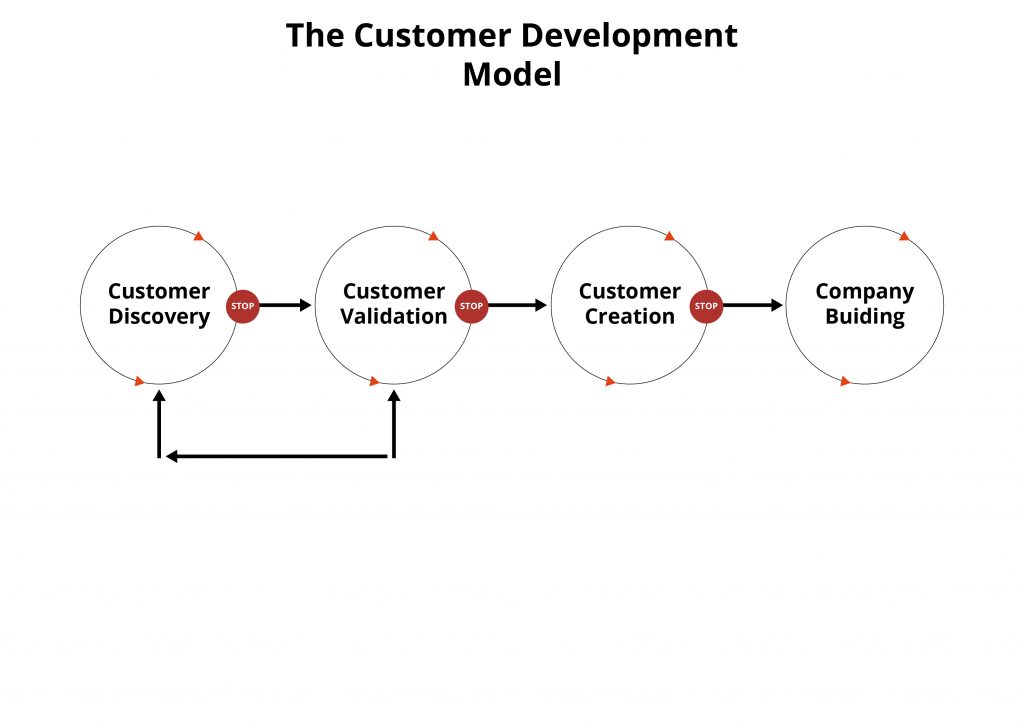

The question of PMF is relevant throughout a startup’s lifecycle. For example, according to the ‘Customer Development’ theory created by the Silicon Valley-based entrepreneur Steve Blank, a startup should pass through four stages:

1. First, startup founders are discovering who the customers for their product are and whether the problem they are targeting to solve actually matters to customers. They need to get “outside the building” and learn what high-value customer problems are, what solves these problems, who will influence the buying decision, and who the actual end-users will be.

2. Only sales prove that a startup has found a set of customers and a market that react positively to the product by paying money. The second phase, customer validation, is about successfully selling the product to early customers. It should result in a field-tested process that can be replicated later by the sales and marketing teams.

3. Customer creation builds on the previous stage’s success to create end-user demand and drive it into the company’s sales channel. Heavy marketing spending is justified only after the startup has acquired its first customers.

4. Finally, exploiting the early market success, the startup can transition to a well-oiled machine with formal departments and VPs of Sales, Marketing, and Business Development.

It may take startups several iterations of each step until they get everything right.

Alternative-spaces’ software development teams normally use the Lean Startup build-measure-learn cycle combined with the Scrum framework. When they undertake a project from the start, they validate the client’s assumptions at every stage:

1. They start by exploring, understanding, and validating the product concept and creating a shared product vision. UI/UX experts help develop a clickable mockup to explore different ideas and lay out the product’s basic structure. The product discovery stage should produce deliverables necessary for building a potentially market-fitting product.

2. Once approved, the app’s graphic design is completed and a minimum viable product (MVP), the first usable version of the product, is coded. After the MVP’s launch, the client will be able to learn whether there is a demand for their product.

3. The feedback they obtain will likely indicate a need for changes. Swift product iterations resulting in new releases should improve the product so that it can achieve PMF. Otherwise, the MVP may be completely overhauled to meet the needs of the target market.

The main reason to watch out for product-market fit is the necessity to scale the business. Often, startup founders may scale too soon, mistakenly believing they have reached it. This may kill startups that don’t have sufficient cash flow to support quality software engineering and new hires, marketing campaigns, etc.

The opposite is equally undesirable: startups that are overly cautious and slow to grow may be caught by PMF off-guard. Suddenly, the product usage would skyrocket, and they would be unable to keep up with a flood of users and sales deals. Both scenarios will also entail an influx of customer complaints and refund requests, damaging the company’s reputation.

It becomes reasonable to take on securing growth capital, ramp up your sales and customer support teams, and scale up your marketing campaigns only after realizing a definite product-market fit. However, this success is not necessarily associated with immediate impressive growth either. It’s more common for startups to find traction in sub-markets and progress towards their ‘good market’ bit by bit.

A ‘good market’ also means high competition. Even if you capture the lion’s share of a market, your solution may soon become obsolete due to technology changes, and other good-fit businesses can leapfrog you. The best way to overcome competition is to be the first to find product-market fit.

The only way to survive and grow in the developing market is to accelerate, watch for changes, and continually improve the product to match the target users as closely as possible, hitting PMF again and again.

A business that fails to fit its product to the market is unlikely to survive. It may have an illusion of temporary success, but the customer base will not grow, the product will not be profitable, and sooner than later the founders will find themselves back to square one without a sustainable budget.

There is no secret recipe for success and every startup is unique, so it makes no sense to try to replicate even the most relevant product-market fit example. There are some best practices, however, which may benefit any SaaS company.

Tips for SaaS Startups on Finding Product-Market Fit

1. Research and calculate your ‘good market’ from the onset.

You need to be reasonably sure about the market to launch your MVP. It’s essential to find a customer segment that may be dependent on your product and become loyal subscribers: a SaaS business needs recurring revenue to survive and grow.

You need to understand your customers. Make a list of people or businesses whose requirements and feedback will be most valuable based on their location, income, age, gender, lifestyle, and other demographic categorization.

Start by talking to potential customers about any problems they are experiencing that your SaaS might solve. Focus on the consumer groups that really need a solution. Your goal is to provide something that a customer either can’t live without or wouldn’t want to give up. The understanding of your target audience will inform your startup’s offering, value proposition, marketing strategy, and marketing plan.

It’s also important to know how big your potential market is. You can use the total addressable/available market (TAM) metric to estimate its size and potential revenue. There are three options for calculating TAM:

1. The top-down approach, which extrapolates the size of the TAM from industry research

2. The bottom-up method, which uses data from your early sales

3. Value theory estimating how a product’s value will affect buyers’ behavior

Top-down TAM calculations use industry findings by Forrester, Gartner, and other market research and consulting firms. It is often presented as “This industry is a $X billion market” and lets you discover how many end-users meet your market criteria. However, such research rarely meets a startup’s exact specification, carries much uncertainty, and generally isn’t very actionable. Companies often hire third-party consultants to conduct email or phone surveys, analyze other research, make more educated assumptions, and provide a more tailored view and market size estimate.

Bottom-up calculations give a more accurate estimation of revenue sums and market growth. However, this technique requires a startup’s own sales data: it needs to extrapolate from the current pricing and usage and apply it to the wider customer base of the target market.

Suppose your B2B company sells a solution for firms with 50-100 employees. In that case, you can calculate the number of such firms in the appropriate sector, the average number of employees, and how many will be likely to use your software.

TAM = Annual Contract Value x Number of possible accounts in your industry

The value theory method is best for getting a sense of the TAM for new features, upgrades, or a new product that will effectively create its own category. This method estimates the value that a product provides to specific users and whether the business can sufficiently capture that value through pricing. You need to know what customers value and how much they may be willing to pay for it. Next, you need to estimate how many customers may find that value in your product and prefer it to alternatives.

If you identify a very small TAM, it’s an early indicator that you will likely need to target a broader audience.

Once you’ve figured out your TAM, you can determine the percentage of customers. It’s unlikely that 100% would buy your product, so you should set attainable goals for a portion of that market you can capture. Over time, the percentage will theoretically increase as you get closer to attaining PMF.

First, narrow down TAM to Serviceable Addressable Market (SAM), i.e. what is within your geographical reach, and from there “guesstimate” the Serviceable Obtainable Market (SOM). Your SOM is basically how much of the pie you’ll get. It should also grow over time and depend on how much of the SAM will want to buy your product, what portion of the SAM your marketing and distribution channels can reach, and the strength of your competition.

In the beginning, your product will likely satisfy only a small segment of the market. As your understanding of the customers’ problem grows, your customer profile may evolve too.

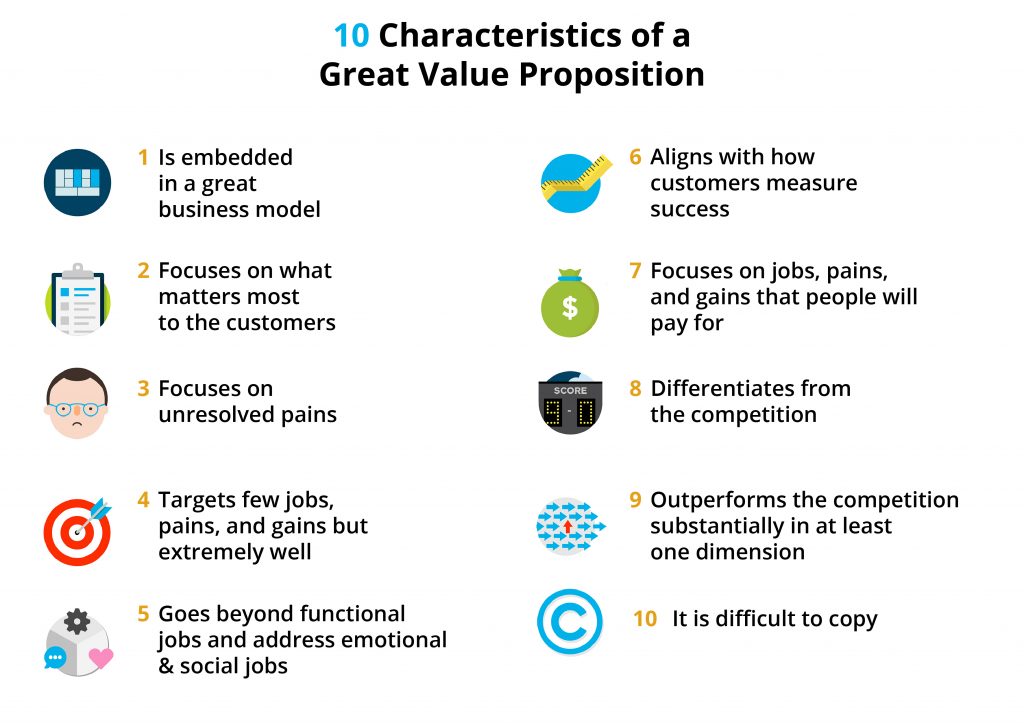

2. Work out a sound value proposition.

Product-market fit requires the understanding and validation of solutions to the customers’ burning problem. Unique Value Proposition (UVP) should describe how your product solves it, its specific benefits to the customer, and its advantages over the competitors.

Image source

Startups need to formulate a value proposition both before launching a product and after finding product-market fit, and it may take several attempts to come up with a good UVP.

Remember that you may first need to educate the market about the benefits of your SaaS app. This takes time and costs money.

You may need to re-propose in response to the market’s reaction. Sometimes, it could mean pivoting from your original idea. Sometimes, innovating to deliver a fresh solution to a problem you hadn’t foreseen. Sometimes still, quitting a specific market segment that is not going to fit. Your second or third attempts may not be perfect either, but quicker iterations will likely hasten the day you hit PMF.

3. Create a sample product quickly.

A minimum viable product (MVP) will enable you to test the key functionality and design quickly and at minimum cost. It can be tested by potential users or field experts and improved before your product hits the real market. Employees may be using the product as a sort of alpha test before releasing it into the hands of your beta testers, but user research is mandatory.

If your sales cycle extends too long, the team may be slow to learn about demand and usage. In this scenario, it is usually best to offer free access to early adopters in return for prompt feedback and case studies. Even if your MVP is saleable, the most important objective is to listen to what people say about your SaaS product.

4. Collect and use customer feedback effectively.

Direct unbiased customer feedback should be a SaaS startup’s guiding star on the path to product-market fit. Build a company culture that continually seeks to understand and meet the customers’ reasonable needs as successfully as possible.

PMF surveys are a standard method. Targeted knowledge of your market will enable you to create better surveys that answer those very specific questions critical to understanding your target audience’s needs.

Through your questions try to assess your product’s significance for customers and how they would want it to be. Try to keep your surveys short and use wording that is easy to understand. It’s best to use a mix of multiple-choice and open-ended questions to elicit more details.

In general, you are most likely to need information about your customers’ background, such as their job and typical workday, their pain points, what solutions they have tried, and how they are using your product.

You can use Google Forms or other popular online survey builders that will also help you analyze and interpret the answers. Most startups use templates for net promoter score (NPS) surveys that they send by email. This makes PMF surveys look generic. Pop-ups on the website also lack human interaction in the process and can even interrupt the user experience.

Another common mistake is that the marketing and customer support staff are more involved in the process than the product team. The latter should actively participate because they know the product better than anyone and may have additional question ideas to facilitate better results.

The type of customers (e.g., leads, free and paying customers, or highly-engaged beta users and customers who rarely use your SaaS) greatly affects the value of their feedback for your business. If you have different categories, it’s recommended to record their feedback separately. For example, if you need to reduce customer churn, canceling users’ feedback may be particularly useful.

A small and very young startup might not have vast numbers of paying users, but even 40-50 responses can often prove valuable. Of course, the more people you survey, the more useful your findings will be.

Provide your users with various convenient feedback channels inside your SaaS app: enable them to rate features and request new ones, report bugs, ask questions, and more. Your product usage data will also help you improve product-market fit. The usage metrics promote clarity about which features are being used and which are not, what is easy to utilize, what is difficult, and more.

Your customer support staff that directly interacts with the users is an excellent source of valuable information, e.g., what customers are complaining about or struggling with. However, it works best if they work in-house. Each complaint or feature request may teach you something about demand and accelerate your progress towards product-market fit.

It’s often recommended to apply a more personal approach, e.g., by making personal phone calls, videoconferencing, or inviting your customers and end-users to your premises. The answers you may receive will be comparable with a standard PMF survey, but your genuine interest in the customers will encourage them to share more details and insights. This will help you identify problems, generate ideas, and build relationships.

5. Perfect your customer experience.

Best companies are constantly improving their products and services to meet the market’s needs better and remain competitive.

Startups need to concentrate on making their early adopters happy with the SaaS product or, initially, their MVP. SaaS products are flexible; the ways of tweaking them include, but are not limited to:

- finding out further pain points of the customers

- touching a new segment

- modifying the design

- adding new features

This should go hand-in-hand with the customer experience optimization, from your SaaS landing page’s calls-to-action through the point of commitment. The improvement will boost user satisfaction and increase the user base.

Continue to make and test your assumptions and improve your SaaS to meet the customers’ changing needs. You should create a continuous loop of customer feedback and SaaS product development that increases product-market fit on each iteration. Listen, build, deliver; listen, build, deliver. If you haven’t yet succeeded, try again.

It’s useful to set up a system where your product team can report and store customer needs and problems. It’s also beneficial to analyze the top complaints your customer support team receives from customers within a certain period. Just make sure the issues are not ranked based on the duration of calls or the time it took to fix a problem.

The key to success is to understand what the core group of dedicated users love and make those items even better. You also need to find out and resolve the issues that are holding back on-the-fence users that match your identified personas. Your subsequent product roadmap should reflect both these objectives.

Don’t rush to do something just because somebody asked for it. It’s nearly impossible to please everyone, so it’s best to prioritize paying customers. By “doubling down” on those who truly value your product, you will be able to invest in the most relevant features and improvements and attract more paying customers. You will also need to learn to say “No” to prospective customers who don’t match your company vision and values.

First, verify if the feature requests fit into your roadmap, and then prioritize based on how many users they will affect, how long it will take to deliver each one, and whether they’ll give you a competitive edge.

Adopt rapid product iterations for building and enhancing the features, testing them, and honing them further. They need to be A/B tested against the existing product version with chosen groups of users.

If a new feature fails, cut it off. If it seems to succeed, be quick to build on the success. You can assess the results of these efforts by measuring the percent of the TAM you serve. If it increases, you’re likely headed in the right direction.

It may be useful to publicize your lists of features that are “currently in development” and “planned.” Similarly, be transparent when the time comes for radical changes to your business model. For example, when Basecamp was about to target a new market, they built three different versions of their product for customers to move to if they wanted.

6. Opt for Agile and automated processes.

For startups that are still trying to validate hypotheses, the top priority is to quickly iterate on the product and positioning. Afterward, responding to market needs quickly and effectively remains key for SaaS products’ survival. This makes Agile methodology look like the best option for your software development process. With constant evaluation and validation, the incremental approach keeps the development on track, focused on quality, and helps fine-tune your product until it’s just what users want.

It’s even better when marketing supports the development with customer feedback. The product and marketing managers should collect as much information as possible, analyze it, and share the findings with the whole team.

Automated integration, testing, and deployment also help companies quickly react to changes in market demand and customers’ requirements. Automated testing is especially useful when they are regularly redesigning and refactoring the product.

Together, all these practices accelerate customer-driven innovation and achievement of product-market fit.

7. Try a proven business model.

Do your research into the business models of similar startups in your segment. It may be reasonable to try to replicate a field-tested successful model.

Imagine you have followed all of the best practices and used all opportunities to ensure PMF. How can a startup determine whether these efforts have been successful or whether it’s at least on the right track? The following chapters will offer some tips on how you can confirm PMF or gauge your progress towards the goal.

How Your Customers Can Help You Understand Your Product’s Position

In a SaaS startup’s early days, quantitative data like engagement and NPS may be helpful, but the most important thing is to listen to customers.

Luckily, SaaS products are essential business tools that customers take rather seriously. Early adopters are usually a product’s biggest fans, but all customers normally would be glad to provide feedback and criticism about how you can best meet their needs. (They’ll want to see it acted upon quickly, though.) By leveraging the always-on connection between the SaaS company and its customers, startups can automate and accelerate getting and acting upon customer feedback.

For a very young business, having even ten unaffiliated customers may indicate you have created something valuable to build on. If you listen carefully to these customers, they will give you the necessary feedback and a roadmap that will eventually help secure another 1,000 customers.

The most effective way to learn your customers’ opinions is through conversations on the phone, over video conference, or in person. If you can commit to talking to your customers weekly, you will uncover critical and often overlooked insights into their needs and how you might provide a better solution, as well as substantial context to the quantitative data we’ll discuss further.

B2B SaaS providers may establish a customer advisory board (CAB) by selecting 5-7 early adopters who are eager to provide feedback and are proficient at articulating how they work, their problems, and so forth. The CAB may hold its meetings monthly or quarterly.

They say you can start sending out PMF-related customer surveys after you have acquired at least 100 paying customers. For example, it’s possible to measure PMF by calculating the percentage of customers who think your product is a ’must-have.’

However, surveys may provide more of a leading indicator than concrete proof of PMF. It’s safer to take bets on what people are doing, not what they say, so PMF correlates less with stats and estimates and more with a thorough understanding of your customers’ needs, behaviors, and attitudes.

Sean Ellis, CEO of GrowthHackers, suggests a quick and dirty way of gauging PMF. You may ask existing users “How would you feel if you could no longer use our product?” and suggest three answers to choose from:

- very disappointed

- somewhat disappointed

- not disappointed

You can also use the opportunity to ask open-ended questions about your product to gain additional insight.

It’s best to survey people who have experienced the core of your offering, those who have used your product at least twice, and those who have used it in the last two weeks. 40-50 respondents should carry statistical significance.

If at least 40% respond they would be ‘very disappointed,’ this is a strong sign of finding product-market fit and that you can build scalable customer acquisition. You can decide either to “double-down” on product development or to start scaling up your sales, marketing, and customer success.

This is also a proven tactic for identifying the population that makes a product’s TAM. After distinguishing your ‘very disappointed’ users, you can analyze them “persona-wise” and what they value about your app.

Imagine that 1,000 people have downloaded your app’s first version. Of those customers, 400 said they would be ‘very disappointed’ to lose it. Those 400 users are a snapshot of your target market which you can analyze. For example, knowing that most of them are affluent professionals in their 30s, you may try to determine how many similar people exist. This will give you your TAM for that persona.

How Quantitative Data Helps Detect and Measure Product-Market Fit

After your product has been on the market for a while, you can collect, analyze, and rely on quantitative data to determine if you have product-market fit. The exact measure of success may depend on your individual SaaS product and the market you’re pitching at. For example, for a new app, it might be an agreed threshold number of paying unaffiliated customers. In other cases, it may be revenue generation, activation, customer churn, customer success, or a combination of several key SaaS metrics.

It’s also important to have a sufficient sample size to represent an entire market so that you can draw a reliable conclusion. There is a divergence of opinions about what feels like a good representative data point, but a general rule of thumb requires the number to be in double figures.

Measuring product-market fit, SaaS businesses often assess things like:

- their customers’ level of satisfaction

- the level of their engagement with the product

- how often their customers use the product

- organic growth (how many new customers acquired through word of mouth)

For example, at least half of new signups ideally should be coming from direct or organic traffic sources.

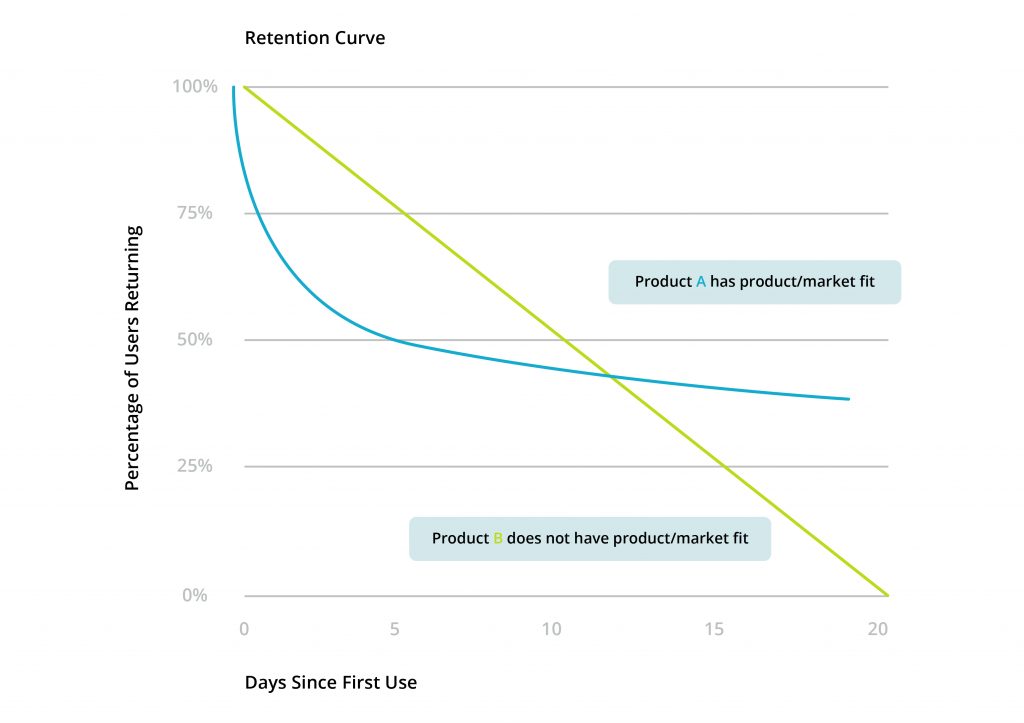

A growing user base is a good sign, but early users must continue to engage and find the product valuable over time. Analyzing your retention curve is a great way to measure PMF. This line graph depicts the average percentage of active users for each day within a specified timeframe. It’s best when the first few weeks of churn look like in the graph below, and the new user churn flattens significantly after Week 1.

Image source

Combined with Sean Ellis’ method, NPS may be the first step towards discovering if you’ve found PMF. NPS is essential because it tells you both how happy your current customers are with your product and how likely they are to bring new customers through word of mouth.

To calculate your NPS, you need your customer base to estimate the likelihood of recommending your SaaS product to a friend or colleague using a 0-10 scale.

Tracking NPS scores with early adopters and following up with those who showed scores of 0-6 could give you insights quickly. An overall NPS score above 60 or an average score of 8-10 for all your NPS surveys is usually a strong indicator that you’ve hit PMF, but the metric has to be combined with others to be sure.

For example, you may compare it with your CSAT (customer satisfaction) results. The customers need to rate their overall satisfaction with the product as:

- very unsatisfied

- unsatisfied

- neutral

- satisfied

- very satisfied

It makes sense to send these questions only to people who are engaged with your product.

One of the most recommended frameworks for measuring PMF is the Pirate Metric Framework coined by Dave McClure. He broke it down into five components.

- Acquisition: How well are you getting customers to your app?

- Activation: Are your customers having an excellent ’first run’ experience?

- Retention: How often are your customers coming back?

- Referral: Are your customers telling others about your product?

- Revenue: Are the customers paying for your service?

When lead velocity starts growing significantly, and conversion and usage rates follow suit, product-market fit is likely to have been reached.

The product usage interval is the frequency (daily, weekly, or monthly) with which you expect people to use your product. The expected number may vary depending on the product type you are offering, but the more often users come back to use your SaaS product, the more likely they are to stick with it for a long time. If they keep returning to it every day, it means that they are dependent on it.

If you’re achieving PMF, your acquisition rate should also be trending down over time while your retention rate is trending up.

A high retention rate is a great indicator of a SaaS company achieving PMF.

Keeping your churn rate slow in the early stages is a sign of approaching or finding product-market fit. A churn rate below 20% is a good sign.

Pardot founder David Cummings believes that if you’re able to satisfy the following five criteria, you have a good indication that you’ve hit PMF:

1. Over 10 legitimate customers have signed up in a short period (typically 3-9 months).

2. At least 5 customers are actively using the product with little or no product customization.

3. At least 5 customers have used it for over a month without finding major bugs.

4. At least 5 customers are using the product in a similar way and achieving similar results.

5. At least 5 customers demonstrated a similar acquisition and onboarding process.

These goals are designed as benchmarks for monitoring early-stage startups’ progress and provide insights into how PMF can be continually improved.

They’re also very actionable. If new customers are missing out on most functionality, improve your onboarding process. If there have been lots of bugs, invest in your product development.

For growth, your total number of customers isn’t as important as the quality of those customers. Ten customers that fit your ideal customer profile weigh more than a large number of random customers signed in the near-term. By focusing on small samples, this test also makes it easy to get a snapshot of progress towards PMF. This is most relevant to the B2B sector, particularly those targeting the Enterprise.

To make this model more applicable to B2C SaaS, it’s necessary to increase the sample size by at least tenfold.

If the average revenue that a customer brings over their account’s lifetime (CLV) is lower than your customer acquisition cost (CAC, i.e. the average amount spent to acquire a single paying customer), it’s unlikely that you have achieved product-market fit.

For example, if you spent $10,000 on marketing in a year and acquired 1,000 customers, your CAC is $10.00. If your customers typically bring you $5 in the first year and never renew their subscriptions, your CLV is $5. That means you need to focus your efforts on increasing customer retention and lifetime value.

After a product has been on the market for a while, you can try to apply the so-called ‘SaaS Rule of 40.’ It implies that the total of a startup’s growth rate and profit margin should amount to 40% or more.

The ratio may vary depending on the company’s development phase. For a mature product, a profit of 35% and a 5% growth rate might be more than acceptable. For a product that has been out just for a few months, this ratio may be a warning signal. These figures may indicate that the target market is too small, the startup’s marketing ineffective, or the prices too high for potential customers.

If a startup’s early growth rate exceeds 40%, but there’s no revenue yet, it’s not necessarily a reason to worry. As the business grows, it can somehow reduce spending or raise the prices at some point to start generating revenue.

40% is rather arbitrary a number and may not perfectly reflect your specific market dynamics and competition. However, this benchmark may help you see if you are moving in the right direction.

Most startup founders agree that the rate at which a business is growing is not an absolute but a significant PMF indicator on its own. For instance, a 15% growth rate for a quarter is a good indicator, but that growth may result from a special promotion or up-sell/cross-sell. However, when a business is growing, especially exponentially, it has most likely found PMF.

It’s also difficult to quantify PMF when it comes to revenue. For example, since SaaS companies may be targeting millions of individual customers at a low price point or enterprise customers paying $100K yearly, the target number will vary greatly. However, venture capitalist Brad Feld claims that you can get a semblance of PMF with monthly recurring revenue starting from $10K. Going from an MRR of $100K to $500K is a PMF sweet spot.

Any test needs to be viewed as a PMF indicator, not as the ultimate proof. The phenomenon is complicated, and its multiple variables we’re trying to measure tend to change frequently. Still, the more evidence you have, the more confident you may be in finding product-market fit and your decision to scale your startup.

Other significant proxies that can tell when you have PMF include but are not limited to:

- A substantial increase in inbound inquiries

- The demand for your product is excessively high, or your company is starting to feel like it can’t keep up with demand any longer

- You feel like the market is dragging you forward, rather than you’re trying to wedge your product into the market

- Your product or business model is hard to replicate

Conclusion

Achieving product-market fit is a crucial event in a digital product development process and the Holy Grail of product management and marketing. SaaS companies most likely to succeed are those that:

- have identified a widespread set of customers to focus on over a long time

- are solving a burning problem for those customers

- are continuously working on adding real value for them

Few companies succeed in finding product-market fit on their first attempt. Most have to go through a process of trial and error, experimenting with and validating different ideas, and learning from their mistakes. It may take multiple iterations over a long time or a single opportunity to pivot and become exactly the product that customers needed.

However, product-market fit is usually a never-ending journey. Customer needs and rivals’ solutions are always changing and evolving. Even a market belonging to one niche can branch in many different directions, and competition can appear like a bolt from the blue.

Once you have a close fit between your product and the market, you have to maintain it while keeping an eye on your rivals and technological advancement. When you add a new feature, re-design the product, or drop your prices, you should be seeking an incremental increase in product-market fit.

Be prepared to measure it using qualitative customer feedback and quantitative data and to analyze it with a dose of intuition. Your product constantly evolving alongside your market means looking for PMF at all times to find out if you’re still providing value. You will surely keep learning new facts for many years after launch.

Businesses continuously fine-tune their products, target markets, and sales and marketing efforts to attain the perfect combination of PMF factors. The task may take a significant amount of time, effort, money, knowledge, skill, and patience.

A startup’s failure at finding product-market fit means working hard for months and wasting money with little in return. That’s why Alternative-spaces combines the Scrum framework and the Lean Startup approach to building software for our clients. The flexible development process supports changes in the client’s product roadmap. Short design sprints facilitate frequent new iterations of a product that users can test quickly. The various experts’ qualifications ensure a high quality of product design, implementation, and maintenance.

Content created by our partner, Onix-systems.

Home

Home