How To Build a Finance Management App With 1 Million Dollars in Yearly Revenue

If you’re interested in building a custom investment management app and need valuable insights, you’re in the right place. This blog post shows how effective cooperation can be between a large outsourcing software development company and an established financial technology company – Raiz.

Table of contents

- The background story

- How the cooperation began: Alternative-spaces’s role in building an investment management app

- Solutions provided by Alternative-spaces

- Raiz functionality

- How Alternative-spaces contributed to the Raiz application design

- Technologies behind Raiz

- Raiz vs Spaceship vs CommSec Pockets: Comparison of three popular investing apps in Australia

- Results we achieved

- Final thoughts

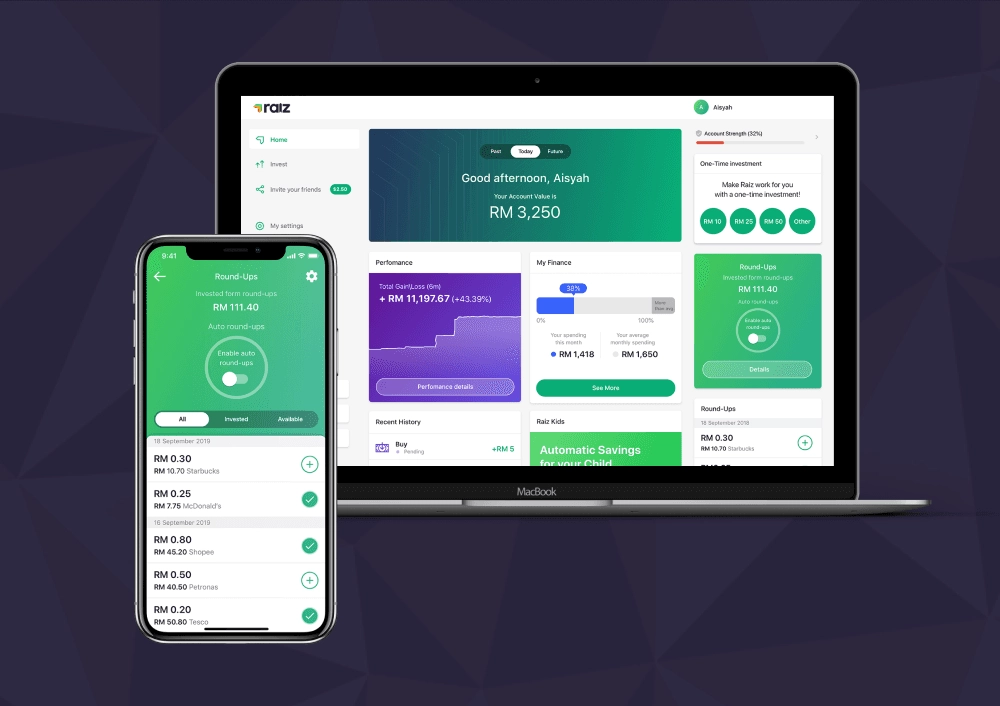

Since 2018, Alternative-spaces team has been assisting Raiz in building a finance management app that offers users an easy way to regularly invest small or large amounts into a diversified portfolio.

Today we’re going to provide you with handy tips and practical tricks on how to build a custom investment management app that will help you grab a piece of the finance market. We reveal our development process, the challenges we faced, and how our experts found the solutions.

This article explains how we managed to win the Australian market and achieve such exceptional results.

Raiz has over $1B of funds under management, with over 1.25 million signups, 584,000 investment accounts, and over 317,000 active customers. And that’s not all of their achievements. Don’t miss an opportunity to learn about useful development insights!

The background story

Raiz is Australia’s largest mobile-first savings and investing platform which operates in Indonesia, Australia, and Malaysia. It provides a way for its customers to micro-invest remaining round-up balances of everyday purchases in exchange-traded funds.

The company was founded in 2015 as Acorns Australia, the local arm of the US-based micro-investing platform Acorns. At that time, the company was about to enter the Australian market and was looking to develop a winning solution.

Once our client formulated their idea, they started looking for a professional design and development company. At about the same time, Richard Brookes, now the CTO of Raiz, who had once dealt with Alternative-spaces, recommended our team for building a new version of Acorns for the Australian market.

This is how Acorns Australia (rebranded as Raiz Invest in 2018) turned to Alternative-spaces for assistance in the realization of their idea.

How the cooperation began: Alternative-spaces’s role in building an investment management app

When Raiz and Alternative-spaces started the collaboration, they already had the original American Acorns application. Initially, our main task was to copy the Acorns code into our repository and maintain it. After some time, we worked on redesigning the app and adding new features that were unique to the Australian market.

Moreover, after a while, Alternative-spaces’s design department joined the project to improve the existing app’s design. So we worked on iOS and Android versions of the app and a web application with a responsive web design.

To deliver a top-of-the-line solution and drive our client’s product to success, we formed a team of highly qualified specialists:

- The project manager who was a bridge between the client and the development team. Our project manager controlled the development process and kept the client informed at all development stages.

- UI/UX designers worked on the product redesign to ensure all the functions solve users’ problems and achieve the business goals.

- Backend developers created a new API to ensure data integrity for the investment product.

- Frontend developers worked on the customer-centric elements of Raiz, bringing the product design to life and ensuring proper interaction.

- DevOps engineer configured the server infrastructure, developer experience (DX), and established continuous integration (CI) and continuous delivery (CD).

The cooperation started with setting up a seamless, effective, and transparent process. At Alternative-spaces, we use the Agile methodology to add more flexibility, speed, and quality to our development process. Agile is a popular development methodology that is used by 76% of IT businesses to enhance project efficiency.

When we started our development process, the team cyclically passed through development phases: planning, development, reviewing, and launching. These development cycles enabled our team to make continuous improvements avoiding development issues and delays flexibly.

We communicated regularly with our client at every stage to keep him informed and gather feedback. Video meetings helped us build strong relationships, guarantee complete understanding, and enhance collaboration.

As a result, our team and clients dealt with a structured, iterative development process that allowed delivering a valuable final product on time.

Solutions provided by Alternative-spaces

First of all, we would like to note that communication is a priority at Alternative-spaces. During the project, our clients are involved in the development process to always be aware of the project’s progress, provide their feedback, and make changes if needed.

Every day we chat with the client and set regular calls to get a full understanding of the scope of work and define tasks. Such frequent communication enabled us to receive immediate client feedback on our team’s achievements and directly synced on project progress.

On the part of the Alternative-spaces team, highly-skilled specialists were committed to working on this project. We worked on the finance management app that runs on three platforms: iOS, Android, and web. We made a great effort to provide effective solutions and, as a result, deliver a reliable, well-performing web and mobile micro-investing platform.

While working on the app development, we actively used pull requests as a part of the daily programming workflow and regularly performed code reviews. Such activities prevent unstable code from shipping to customers until other team members approve it.

The app’s platforms for different countries are based on one codebase, which, depending on the environment, assembles the necessary components. Accordingly, we ensured support for the required languages and currencies. Furthermore, we applied the remote config technique for three platforms that allows us to change features or disable/enable part of the functionality remotely without publishing an app update.

We set up Google Analytics for Firebase to track important events and collect analytics. It provides insight into users’ journeys through real-time and custom reporting. The SDK automatically captures certain key events and user properties, allowing us to define custom events to measure the things that matter to Raiz’s business. Also, we set up Facebook Pixel, which enables us to measure, optimize, and retarget audiences for Raiz’s ad campaigns.

Solutions for the iOS platform

For the current project, we’ve applied the MVVM+Coordinator architectural approach. It allows to maintain high code readability, as well as flexibly customize navigation within the application.

Security is a top priority of any product, especially a fintech one. That’s why in addition to credentials, we integrated biometric verification, namely Touch ID and Face ID. Biometric scanning operation allows users to enter the application securely with minimal effort.

Also, our specialists implemented the feature flags mechanism, which consists of two parts:

- feature flags via Firebase Remote Config. It’s flexibly configured for dev and production environments for each country separately.

- local flags and parameters that don’t change often. They serve to separate properties and characteristics that behave differently in different countries.

Moreover, we used targeting technology to separate the codebase between countries within the application. It allowed us to link code and files for each country separately, as well as add settings individually for each application.

Solutions we implemented for the Android platform

In the Android version, just like in the iOS one, we used the biometric capabilities of smartphones, which provide users with access to the app without entering passwords.

We also created one common codebase for all countries (Australia, Indonesia, and Malaysia), which is functionally divided into android flavors and feature flagging.

What is more, we covered the part of the project with UI and unit tests. These types of testing allow us to

- make sure that an app’s UI empowers users to make the most out of it with the least effort;

- verify whether a small and isolated piece of the codebase behaves as the developer intended.

It’s also worth mentioning that our specialists added the in-app review feature, which allows users to evaluate the application without leaving it.

Our solutions for the web application

Security is paramount in the fintech industry, as it utilizes users’ private data. If at least one security accident occurs, the business’s reputation can be ruined forever. That’s why we adopted the OWASP Top 10 document to ensure a high level of the Raiz app’s security. The OWASP Top 10 is a standard awareness document representing a broad consensus about web applications’ most critical security risks.

Using the OWASP Top 10, we provided the following solutions:

- Security measures during authentication should not be limited to SMS passwords only. We integrated multi-factor authentication to maximize the security level of the Raiz apps.

- We provided cookieless authentication, also known as token-based authentication. It uses a protocol that creates encrypted security tokens and allows users to verify their identity. The token contains information about users’ identities and transmits it securely between the server and the client.

- To ensure a secure and private online experience when using a website, we used Hypertext Transfer Protocol Secure. HTTPS is an internet communication protocol that protects the integrity and confidentiality of data between the user’s computer and the site.

- We used React DOM, which by default escapes any values embedded in JSX before rendering them. This guarantees the impossibility of injecting anything that isn’t written in the app. Before rendering, everything is converted to a string. This helps prevent XSS (cross-site-scripting) attacks.

Raiz functionality

So what’s inside this micro-investing app? Let’s take a closer look at how Raiz can benefit its users and how our team approached the app’s development.

New code for apps

The customer provided the code to start work with, but during the development process, the apps’ code has gone through some transformations:

- The original web app was written in Ember.js. Our team wrote the new code in React.js.

- The original Acorns’ iOS app was written in Objective C. Alternative-spaces’s team has written the new app in Swift.

- The Android version of the app contained legacy code and was written in Java. Alternative-spaces’s Android developers have written the new code in Kotlin.

Backend improvements

The Alternative-spaces team needed to develop a new API that would enable the app to meet the Australian market’s business requirements. The backend was completed in Ruby, while the bulk of the required code in Ruby already existed. So we worked closely with the Australian Ruby team to build a robust API that would bring many advantages, like higher development speed, better scalability, and security.

Our Ruby backend solutions represent a monolithic code base with a few microservices. Many of the API calls are asynchronous to ensure data integrity for the investment product and to make the user experience as smooth as possible.

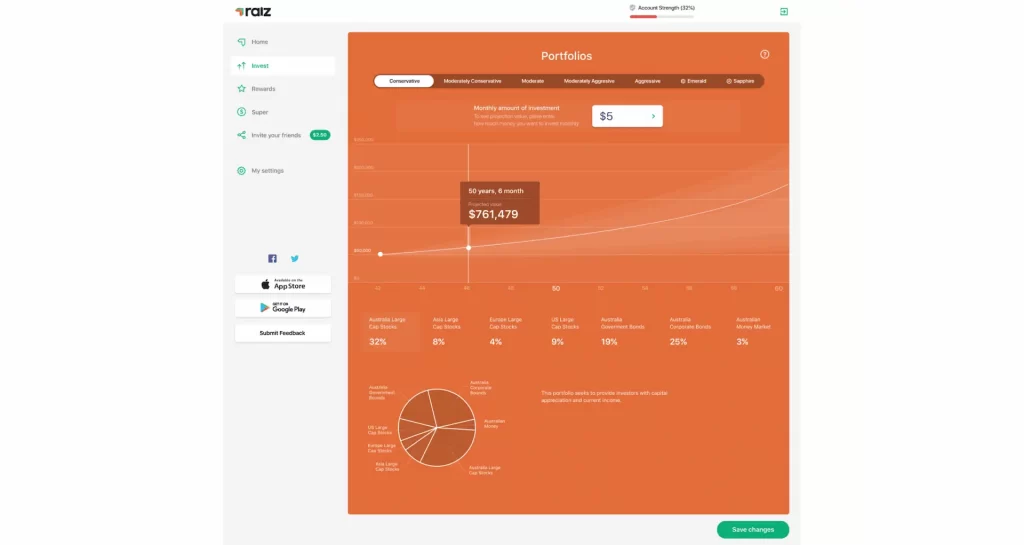

Investment portfolio management

One of the key features our team worked on is effective investment portfolio management. Raiz’s unique algorithm keeps the funds in a user’s account within the chosen portfolio’s target range. Users need to agree to the automated procedure of rebalancing their accounts, which will balance the ETFs despite market fluctuations.

Every time users deposit or withdraw their funds, Raiz automatically adjusts the proportions of ETFs purchased to move the account towards its target portfolio allocation. It also periodically reviews and rebalances the portfolio whenever the percentage holding of one or more ETFs fluctuates 5% above or below its target allocation.

Rebalancing also occurs when users request to change their portfolios. Raiz sells overrepresented ETFs and uses the proceeds to buy underrepresented ETFs to bring the portfolio in line with its new target allocation.

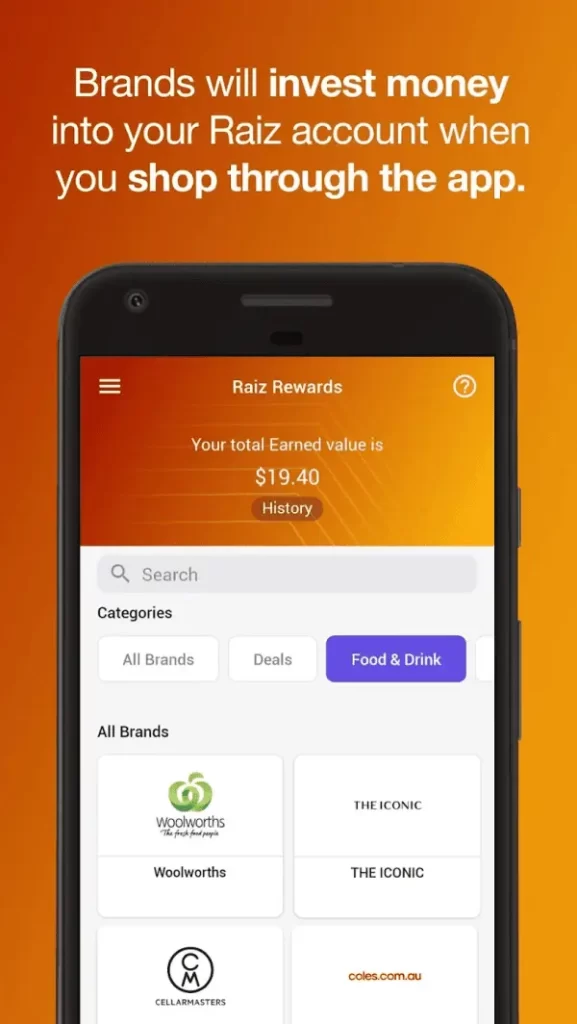

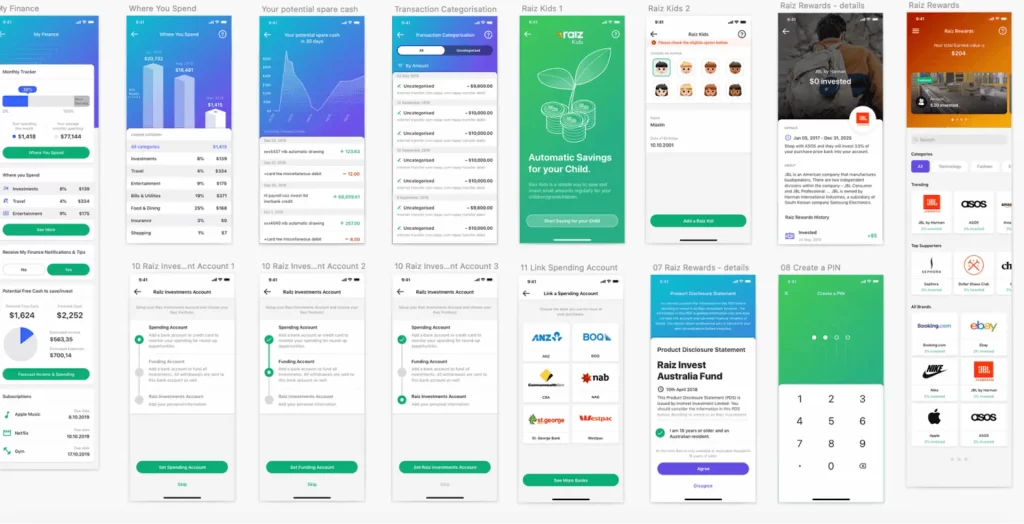

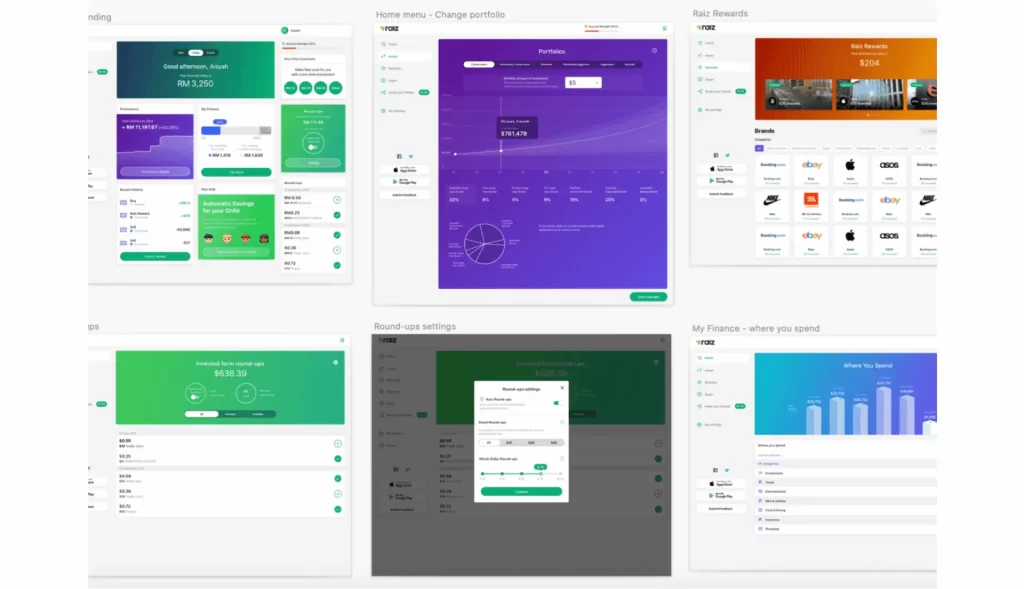

Rewards

Raiz Rewards is a loyalty program. Using this feature, users can shop, and partner brands will invest a dollar amount or percentage of users’ purchases back into their Raiz account.

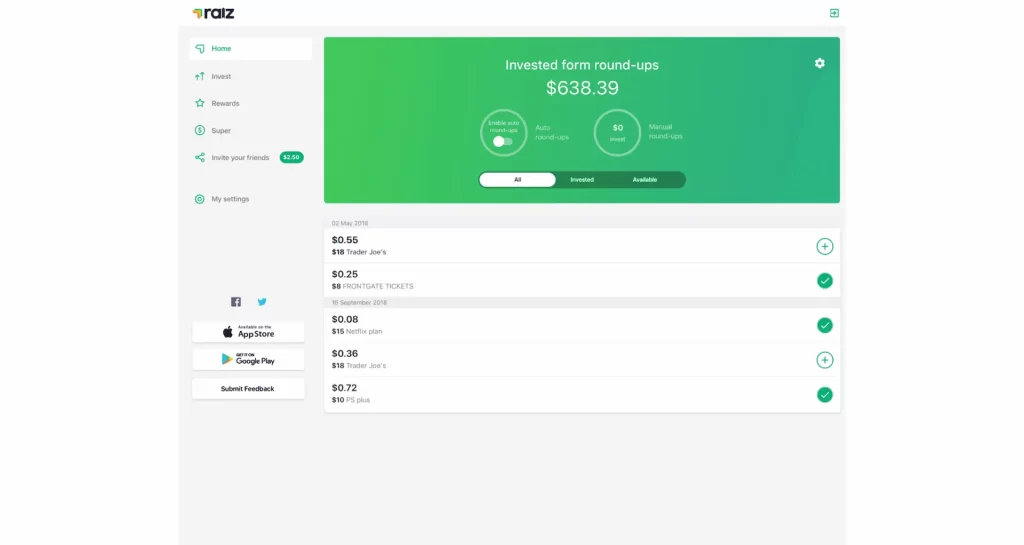

Round-ups

The Alternative-spaces team developed a great feature called round-ups that turns users’ everyday purchases into an investment tool. Users that opt into this feature link one or several credit/debit cards to Raiz’s spending account. After that, whenever they swipe a connected card, the virtual change goes to their account to invest.

The app monitors the user’s EFTPOS transactions and rounds up the spending to the nearest dollar. For example, if they pay $8.40 for lunch, the actual change of $0.60 they would have had is automatically allocated to their account in the app. When the accumulated virtual change reaches the AUD$5 threshold, Raiz automatically invests it into the user’s chosen ETFs. This happens only if the user has selected automatic rounds-ups in the settings. If they don’t select it, then after reaching AUD$5, they can only invest manually.

Savings goal

People set up a savings goal in the app to help them reach their targets quicker. For example, users want to buy a new car for which they don’t have enough money. Using this feature, they can set a financial goal specifying the amount they desire and set a recurring investment to start saving and watch their progress.

Recurring investments

Now, people can easily automate regular investments using the Raiz app. The main idea of this feature is to allow users to set periodic (daily, weekly or monthly) investment top-ups. People can choose a certain amount, the required frequency, and when they want the investment to start.

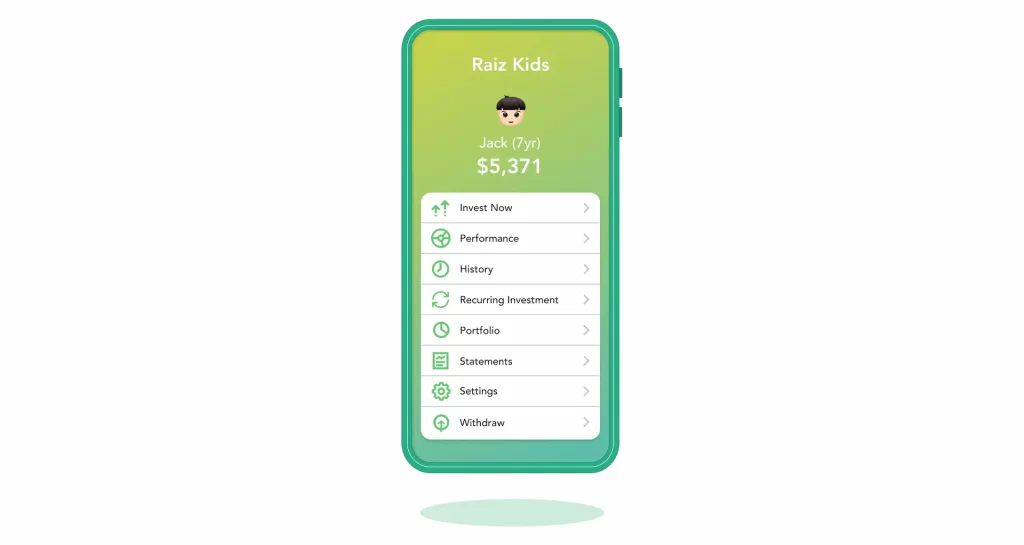

Raiz Kids

The Alternative-spaces team built an investment feature Raiz Kids, which allows users to save and invest for their children or dependents who are under the age of 18.

Raiz Kids account has its own portfolio selection and provides an opportunity to make investments using round-ups, recurring investments, one-off investments, and cashback. Recently we have released the second version of this feature, the primary purpose of which is to develop children’s financial literacy. In the new version, parents can create an account for their child and, with the help of add-ons and restrictions, teach their children how to invest.

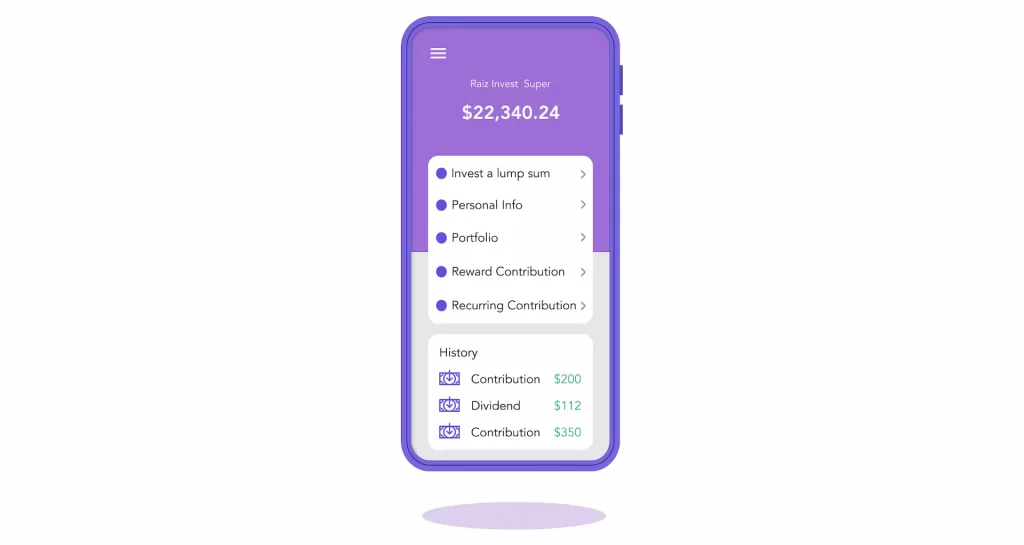

Raiz super

Raiz super is an effective way for people to save for their retirement. Users get an opportunity to invest in the long run with the help of their super account, accumulating from every employer and the voluntary contribution they make.

Users can choose from the same range of diversified portfolios, ranging from a conservative investment strategy to an aggressive one, depending on their goals and risk comfortability.

Throughout the development process, Alternative-spaces’s specialists have maintained and improved the app documentation. Using software development best practices, our team set up a productive working process and delivered an outstanding and robust application.

How Alternative-spaces contributed to the Raiz application design

Alternative-spaces’s design team joined the project to improve the existing application design. The first step was a research and task audit. At this stage, we defined the product vision, the problem we wanted to solve, and the target audience. Our design team determined a fundamental strategy, revealed information gaps, and preplanned the workflow according to a timeframe and resources.

First of all, we needed to thoroughly analyze the wireframes of the Acorns app and the app flows. After that, the department’s art director and one of the designers compiled ideas for improvement and prepared a concept of two mobile screens and one screen for the website dashboard.

This kick-started the product redesign, which progressed through the following consecutive phases:

- Our designers created stunning visuals and delivered a scalable design system to keep the product’s look and feel consistent. This stage included creating the design elements, such as typography, icons, color, and grids.

- We designed several screens in a light theme, and Raiz’s leadership liked the designs and approved the new visual style of the platform. Thus our designer applied it to all approved wireframes of the app screens.

- The art director took over the task of redesigning the Raiz website and dashboard to ensure a cohesive user experience across the mobile apps and the website.

- Our designer drew the new style illustrations for the service’s onboarding pages.

We’ve worked hard to deliver simple, clean, and attractive UI/UX design. Thanks to our design solutions, end-users can use a web app and iOS and Android versions of Raiz quickly and effortlessly!

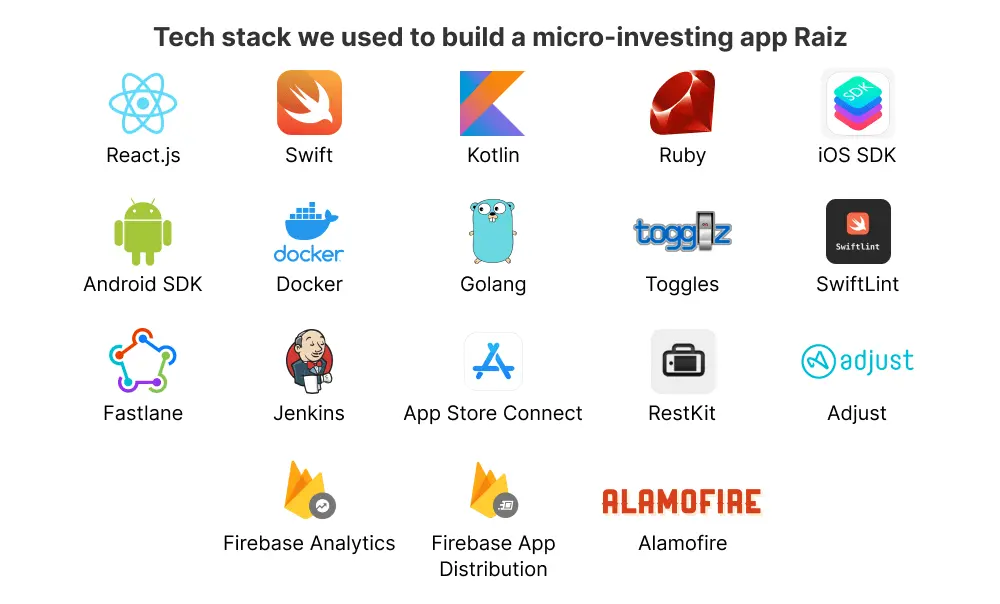

Technologies behind Raiz

While working with Raiz, we’ve used both the latest and proven technologies to ensure a high level of app performance and reliability. Below you can see the technology stack our experts recommended for investment tracking app development.

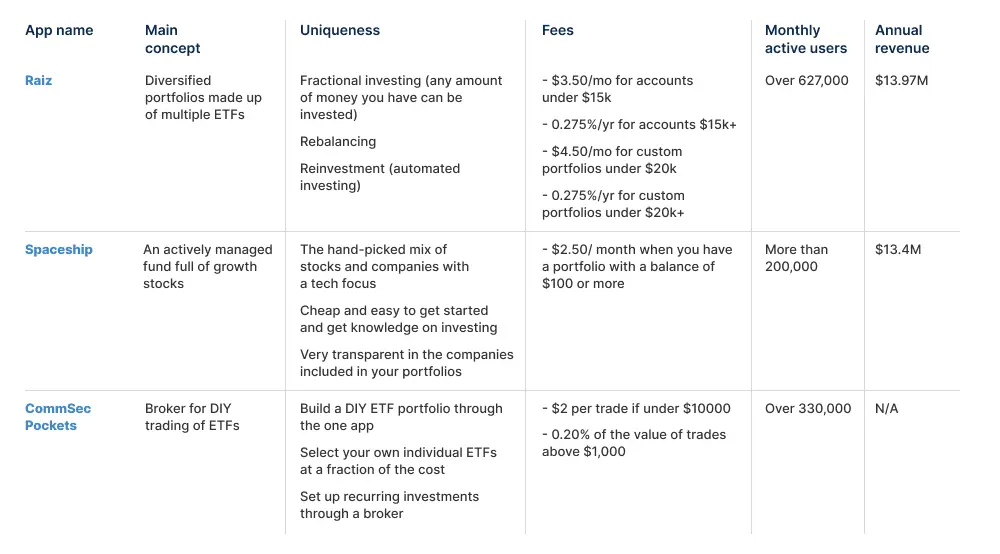

Raiz vs Spaceship vs CommSec Pockets: Comparison of three popular investing apps in Australia

Now that we’ve identified the functionality and all essential aspects of financial planning app development, let’s look how the product establish itself in the financial market. Below we compare three key players in Australia according to some key factors.

We’re proud to be contributing our share of expertise, ideas, commitment, and enthusiasm that empower Raiz to achieve such great results and be among the top Australian micro-investing apps.

The global personal finance software market was valued at $1,024.35 million in 2019 and is expected to reach $1,576.86 million by 2027. So, as you can see, investment management app development is a promising idea in today’s business climate and has excellent prospects.

Mobile personal finance apps have taken the world by storm and are here to stay. Despite existing finance planning apps, there’s still an opportunity to create an investment app and successfully enter the finance market. All you need is to define your target audience and uncover the underlying users’ needs and how your product’s functionality is going to solve them.

The solutions we implemented and the challenges we tackled in Raiz have prepared our team for future tasks we might face. Maybe you have a project idea and are ready to share it with us?

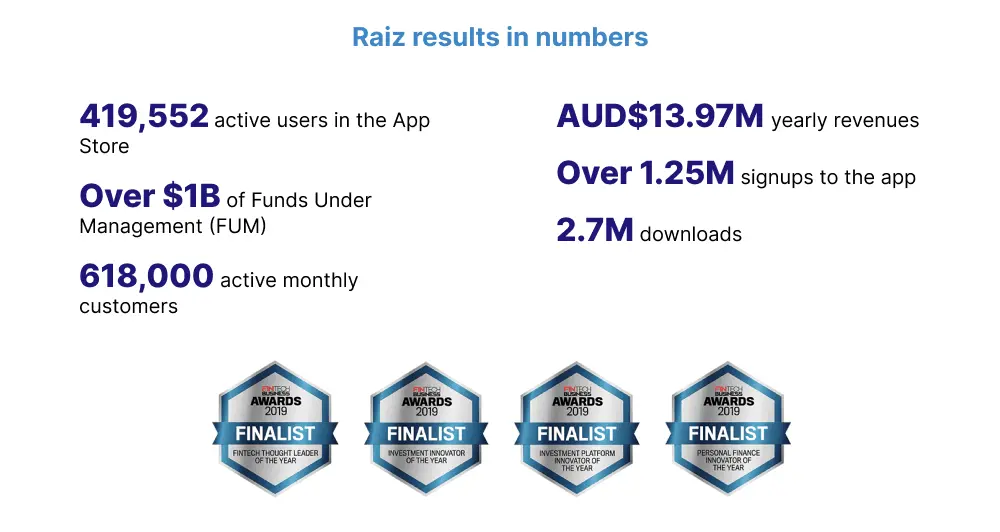

Results we achieved

Our team is glad that we were able to realize Raiz’s ideas and help people save and invest their money in a smart and innovative way.

As a result of Alternative-spaces’s collaboration, our client now operates a reliable, well-performing web and mobile micro-investing platform that offers people a “set it and forget it” approach to continuous investing.

Raiz’s achievements are impressive, including numerous awards and an unprecedented investment uptick. The mobile apps were published on Apple’s App Store and Google Play, were featured in Forbes, WIRED, Bloomberg BusinessWeek, Business Insider, CNBC, Channel 9 News, and Sky Business News, and are still enjoying great reviews from growing audiences.

2021-22 financial years were extremely successful for Raiz: Retail FUM gained a solid 4.4% in July, and the total FUM was $904.82 million by the end of 2021. As of 2022, Raiz has over $1B of funds under management, with over 1.25 million signups, 584,000 investment accounts, and over 317,000 active customers.

In addition, Raiz is ramping up its growth and literacy strategy across Asia-Pacific, with offices in Malaysia and Indonesia with plans to expand into Thailand and Vietnam.

Ready to build an investment portfolio planning app and win the finance market like Raiz did?

We’re proud that our team was privileged to work with the financial technology company Raiz and assist them in finance planning app development. And now, the Alternative-spaces team is ready for the new challenges!

We have 20+ years of experience designing and building fintech products, including personal finance apps, micro-investing apps, and so on. We gladly help you to validate your business idea before starting full-fledged development. Our specialists thoroughly analyze your target market, conduct business analysis, and properly plan your future project to ensure high product quality and deliver a project on time and within budget.

So if you’re looking for investment app developers, we’re here to help! Please don’t hesitate to contact us. Using various cutting-edge technologies and flexible development processes, we’ll build a finance solution with million yearly revenue, or even more!

Content created by our partner, Onix-systems.

Source: https://onix-systems.com/blog/building-a-finance-management-app Home

Home