How to Build a Fintech App: Must-Have Features and Costs

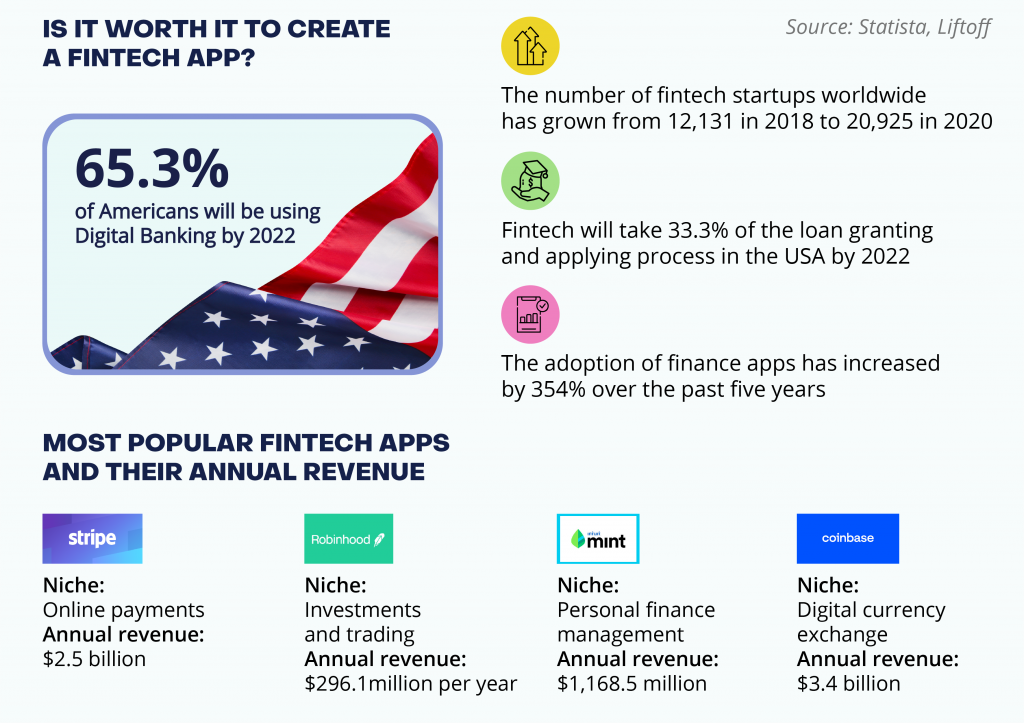

Today technologies are permeating all industries, and the financial sector is no exception. Fintech is a huge market growing at a tremendous rate since it meets customers’ demands for convenient and fast financial services. According to the Research and Markets report, the global fintech market will reach $305 billion by the end of 2025. So, if you’re considering entering the fintech market, now is the perfect time to act.

In this article, we will show you how to build a fintech product the market will be attracted to, explore the required tech stack and critical features, and explore fintech app development costs.

But first, let’s consider how promising a fintech business can be. Below we’ve gathered the essential information you should know about the fintech market.

What are the types of fintech apps?

To begin mobile application development for fintech, you should consider various branches of fintech and decide what type of app your business needs. To give you valuable insight and make it easier for you to choose the right type, we’ve gathered different kinds of finance apps that are currently performing well in the market:

- Online banking. Digital banking apps enable customers to manage their bank accounts and use banking services quickly and conveniently. By using an online banking app, people can perform financial transactions, track their spending, pay bills, and transfer funds. An example of this finance app is Starling Bank.

This digital bank provides users with various features such as detailed control over their debit card, a sneak peek into spending, setting goals for saving money, and much more.

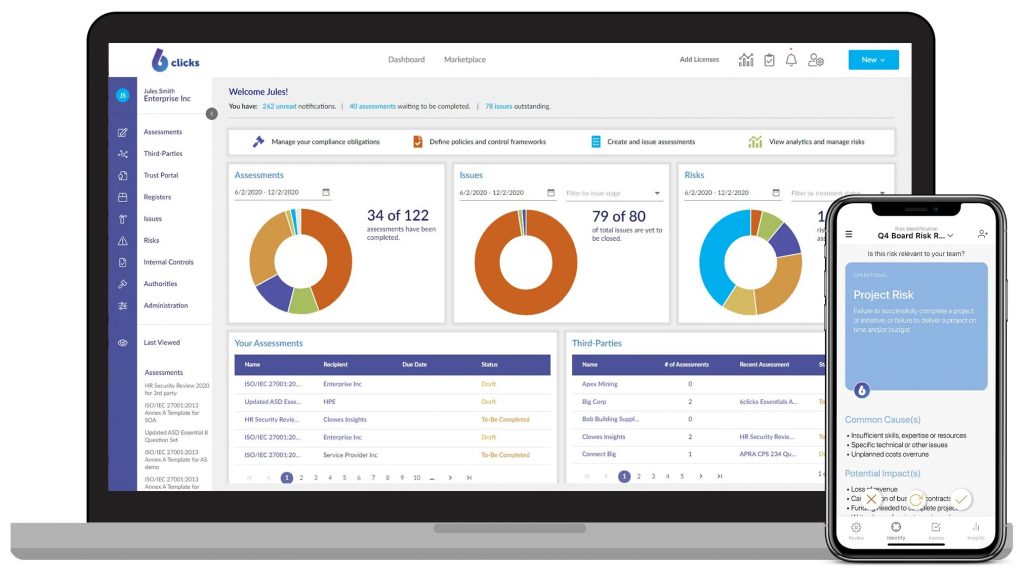

- Regtech. The main idea behind Regtech apps is to solve finance-related regulatory issues. Regtech solutions enable companies to reduce legal problems, analyze their processes, monitor risks, confirm compliance with the law, and generate reports. 6clicks is an excellent example of a Regtech solution.

This Regtech app allows users to identify and assess risks, ensure legal compliance, provide valuable insights on risks that affect a company, and share information with stakeholders.

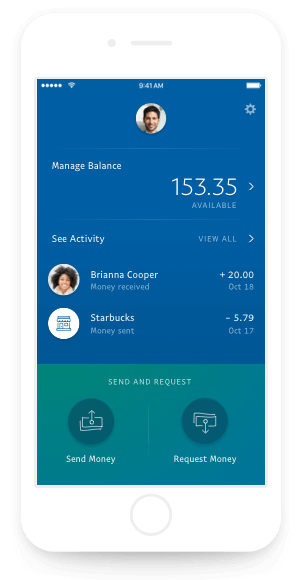

- Digital payments. Digital payments is probably the largest fintech sector. The global digital payments market is expected to reach $7,640 billion by 2024. This type of financial app makes it easier for people to send and receive money from others using their smartphones. Online payment systems, cashless payment apps, e-wallets, and digital currencies – all these solutions belong to digital payment.

To date, PayPal has 403 million active users. This digital payment app allows people to set up a merchant account securely, send money faster, and make online payments without sharing credit card information.

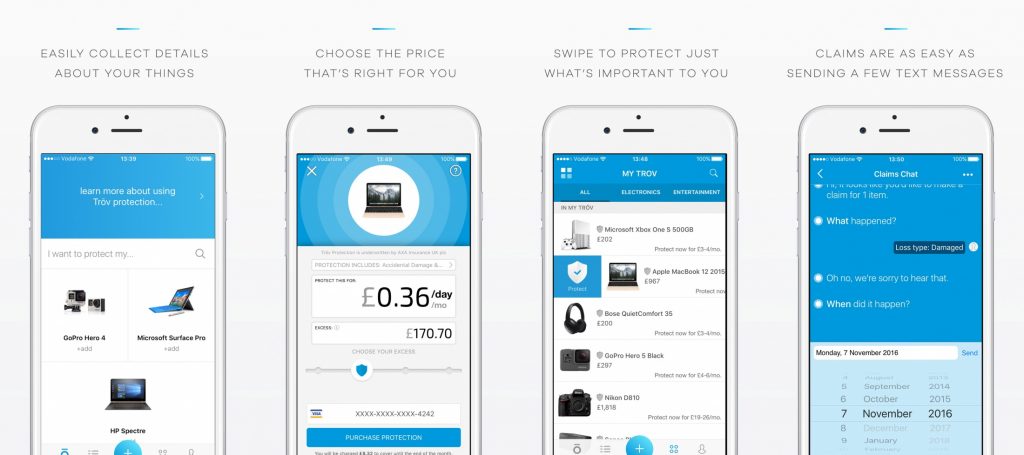

- Insurance. Insurtech solutions aim to provide convenient policy management system automation, accelerate policy administration such as applying for or renewing policies, and simplify processing claims. An example of an insurance application is Trōv.

Trōv is a popular app in the insurance technology market. It provides users with an opportunity to insure their properties digitally right from their mobile device.

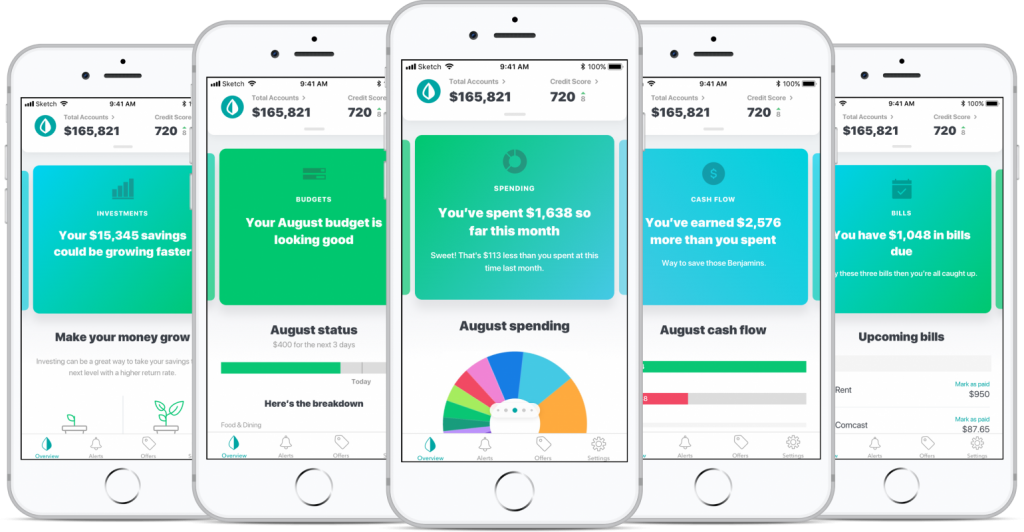

- Personal finance management. This type of fintech app allows users to manage their expenses effectively. Usually, personal finance apps provide an opportunity for consumers to plan their budget, track income, and forecast account balance. Here, Mint is a prime example.

Mint is one of the most popular budgeting apps that helps users manage their money by syncing accounts including bills, user’s cards, checking, and transactions to track spending to provide a complete picture of the user’s finances.

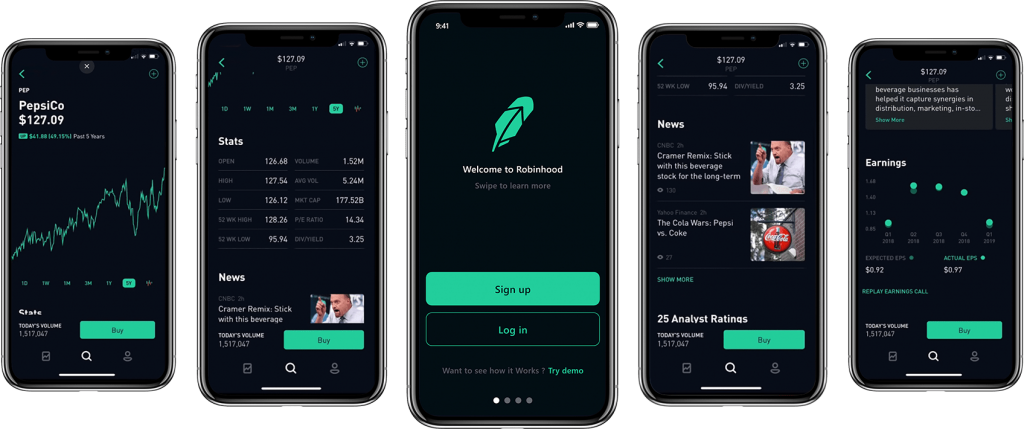

- Investment. This type of fintech app is a perfect choice if you’re going to enter the stock market. An investment app, in some ways, is like a financial advisor. It offers relevant analytics and financial data enabling users to manage their investments effectively. In most cases, an investment app consists of such functions as credit management, currency, research of financial assets, savings, and support. Robinhood is one of the most popular investment apps.

Robinhood is a commission-free investing app that allows users to trade stocks and exchange-traded funds, buy and sell cryptocurrencies, and keep up to date with the latest market activities to invest more effectively.

Now that we know the types of financial applications, it’s time to look at some must-have features to consider when building mobile apps for fintech.

What are the core features of a fintech mobile app?

Financial app development cost consists of multiple factors, including the number of actual features. Before starting financial application development, let’s have a look at necessary functionality:

Secure authentication. Authorization is a crucial feature of any fintech app. Registration enables users to create their accounts and start using an app. When beginning fintech mobile app development, it’s vital to ensure an app provides a simple but highly secure signup process. This can be implemented with two-factor authentication, the integration of face, fingerprint, or voice recognition, unique code generation, emails alert as soon as the user logs in to the app.

Basic functionality for financial operations. When starting fintech application development, bear in mind your fintech sector and what services your app should offer. Based on type, a fintech app can contain such features as account management, balance checking, money transferring, buying tickets, regular payments, etc.

Scanning and QR code. This feature makes people’s life easier, allowing them to avoid entering card numbers. All the users have to do is to scan the QR code using a camera phone. Users then get a notification that needs to be tapped to complete the operation. Moreover, people can transfer money by scanning a QR code in the recipient’s app and confirming the successful payment sum. This feature significantly improves the customer experience, which in turn, leads to an excellent competitive advantage.

Notifications. When starting financial application development, notifications are one of the first features that your fintech application developers need to implement. Custom notifications serve as a direct line of communication between the fintech app and its users. These handy messages keep users up to date with finance industry news and inform them about bill payments, spending, salary notifications, fraud alerts, and many others. So real-time notifications are a crucial tool for engaging user experience.

Data analytics. This feature can be very helpful in tracking and accessing users’ financial activities more efficiently. Users will appreciate an opportunity to view their transaction history, set goals for saving money, track their financial activities and generate reports.

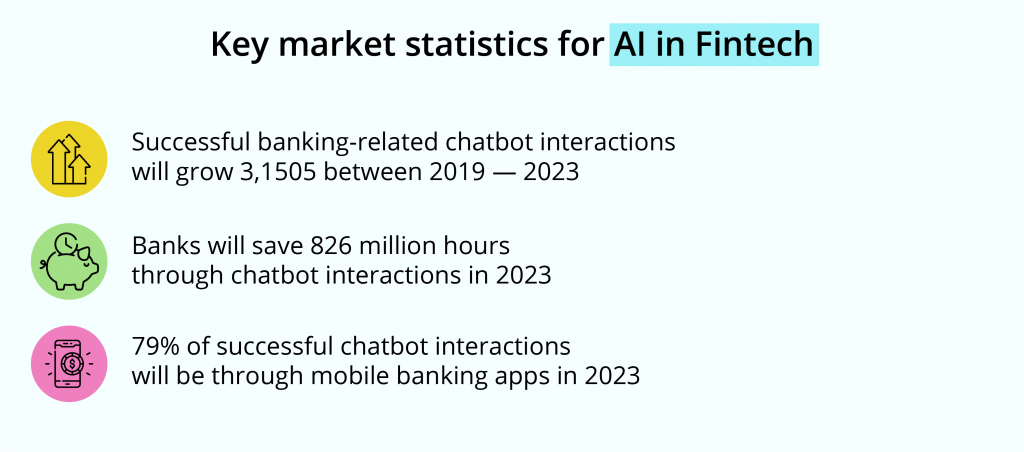

AI-powered chatbot is a must. Any custom fintech app development includes chatbots and virtual assistants. They’re simply a must-have today. These AI-powered virtual assistants automate your customer service, guiding them in the right direction without human help. You no longer need to hire as many employees who will answer standard clients’ questions.

If you are still in doubt about including this feature in your mobile application, check out the statistics below.

Chatbots provide quality customer support 24/7, providing people with an immediate solution to their issues. As a result, your users are helped anytime, allowing your employees to concentrate on more complicated problems.

Integrations. A fintech mobile application needs to be integrated with various other applications to extend functionality and meet numerous users’ demands. Thanks to API integration, you can add such features to your app as mobile payments, geolocation to find the nearest ATM, crowdsourcing, checkout processes, asset management, and so on. For example, establishing a connection with a payment service like Stripe or PayPal enables users to make purchases worldwide. Integrations provide an excellent opportunity to increase income significantly and add enhanced functional capacity to a fintech app.

We’ve just listed the basic functions essential for the MVP version of a mobile financial application. These features will guarantee the proper operation of your fintech app and meet the primary users’ needs. Now we’re ready to consider the technologies necessary for fintech applications development.

What technologies are required to develop a mobile fintech app?

To develop a fintech app successfully, choosing the right technologies is crucial. The tech stack selected affects the scalability, maintainability of the app, development time, and costs. Below we consider three common app development approaches and relevant technologies to create a fintech mobile app:

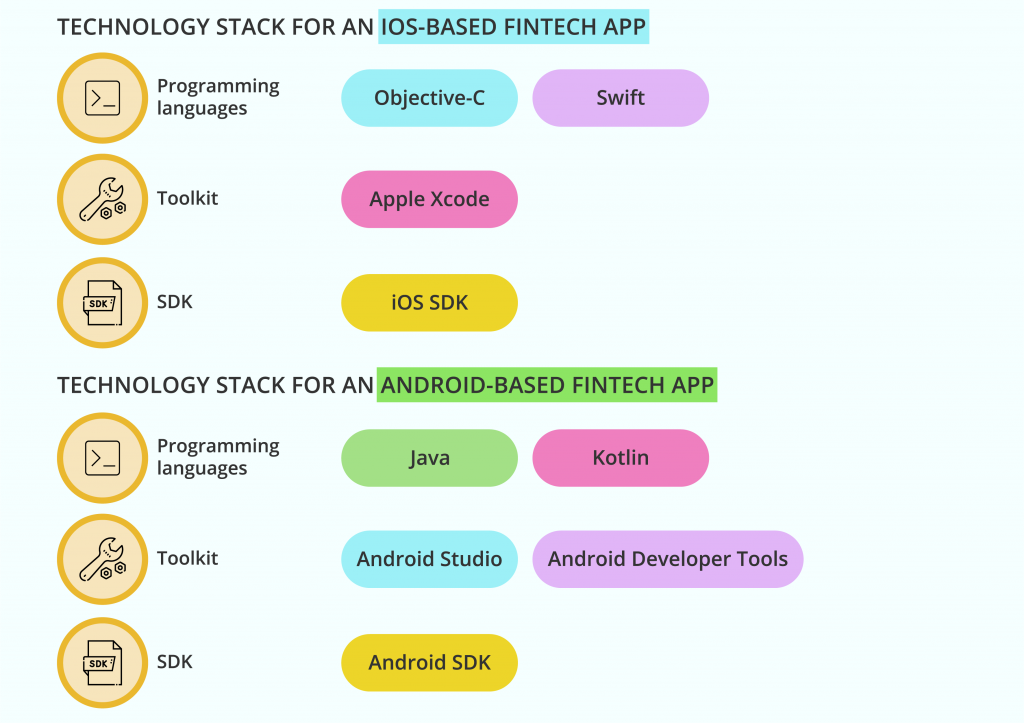

- Native app development is suitable for building a fintech application that will run on a specific platform (iOS or Android). This approach involves using specific technologies and tools for a particular platform. If you want to create a native application, take a look at the following mobile app technology stack:

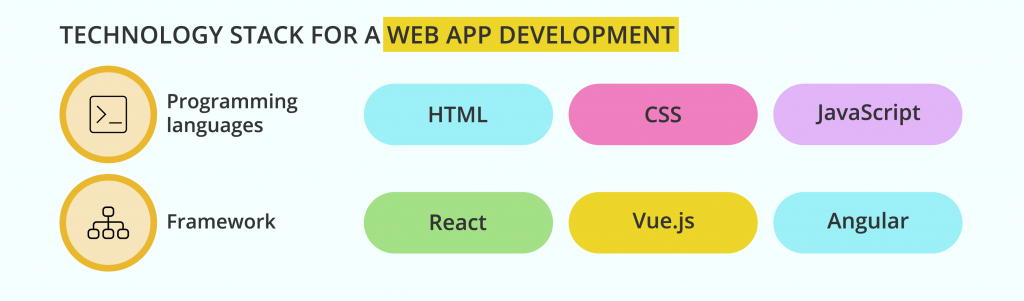

- Web app development involves creating apps that use remote servers and run on a mobile device. This is a great way to be outside the app stores and be available for both mobile and desktop users.

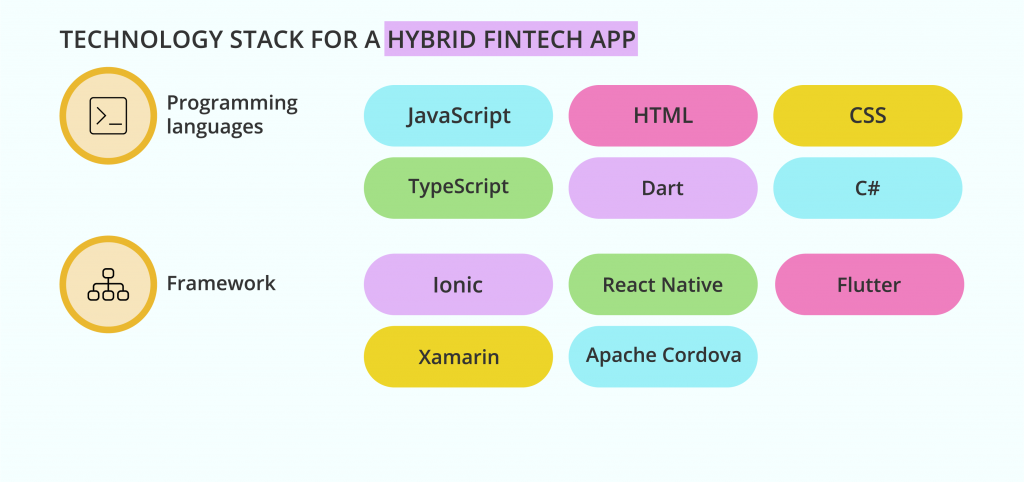

- Hybrid app development allows developers to create apps that are both native and web. In a nutshell, the app core is created using web technologies wrapped in a native container. Hybrid apps operate like websites but can use features of the mobile device. Let’s see what tech stack is required to build a hybrid fintech app:

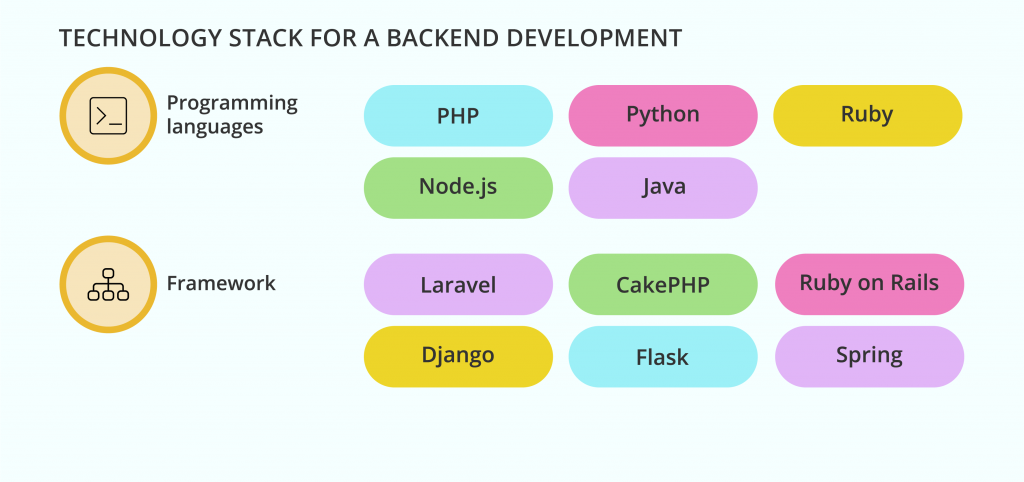

- Backend is a server-side fintech app development that isn’t visible to users. Backend runs on a server through which your application and website communicate to store and arrange data, run your business logic in one place, and host content to display in your fintech app. You need backend development if you’re going to process payments, synchronize data between several devices, gather statistical data about your users, provide users with access to their data, make sure app data will not be lost, and send your users notifications.

There are a great variety of technologies and tools for fintech app development. To make the right choice, it’s necessary to consider such factors as app type, scalability, time to market, and security that is vital for every fintech app. And as long as we’re talking about safety, let’s move on to the legal compliances part.

What are the legal requirements a fintech app must comply with?

Well, if you’re serious about building a fintech app, your next step is to understand local legal compliances and meet them. The Alternative-spaces team has extensive experience in fintech development, and we know how to ensure your app complies with all legal requirements of local policies in which it will run. Now we’re going to review regulations and agencies in various fintech markets that you will need to be aware of.

General Data Protection Regulation (GDPR) is a fintech regulation in EU law that ensures secure client data processing and controls essential data transfers beyond the EU and EEA territories.

Anti-money laundering (AML) is a fintech regulation in USA law that prevents attempts to illegally obtain funds in the form of money laundering, securities fraud, terrorist financing, etc.

Fintech Action Plan (FAP) sets universal rules for increasing cybersecurity of the financial system while encouraging the integration of new technologies in the financial sector.

Electronic Fund Transfer Act (EFTA) ensures secure electronic money transferring using ATMs, debit and credit cards, and smartphones.

Federal Trade Commission (FTC) prevents attempts of fraud and deception in the marketplace.

Electronic Identification and Trust Services (eIDAS) regulates electronic identification and trust services of individuals and businesses.

Securities And Exchange Commission (SEC) is the government agency that guards against market manipulation and regulates the securities markets to protect investors.

Payment Services Directive (PSD) is a European Union (EU) directive to regulate payment service providers and payment services all over the territory of the EU and the EEA.

When building a fintech app, be aware of what requirements apply to your country to ensure your product is in legal compliance.

Now that we’ve decided on the technical aspects, we can determine the cost to build a fintech app.

How much does it cost to create a fintech app?

The cost of mobile app development for fintech is comprised of various factors such as:

- Type of fintech app (investing, banking, insurance, etc.)

- Number of required features

- The difficulty of the project

- The platform you’re opting for (iOS, Android)

- Mobile app development approach (native, web app, hybrid)

- Needed technologies (languages, libraries, frameworks, Blockchain, AI, VR, etc.)

- Team size

- Cost of deployment and support

- Cooperation model(find an outsourcing company, hire freelancers, create fintech dev teams in your office)

To estimate the total cost, you also have to consider the number of fintech specialists you need. Usually, building a mobile app requires a team that looks as follows:

- Project manager

- UI/UX designer

- Backend developer

- Frontend developer

- Quality assurance engineer

- DevOps

However, the number of specialists may vary depending on the type of application, the number of features, and the project’s complexity. For example, if you’re going to build a сryptocurrency exchange app, you’ll need Blockchain specialists.

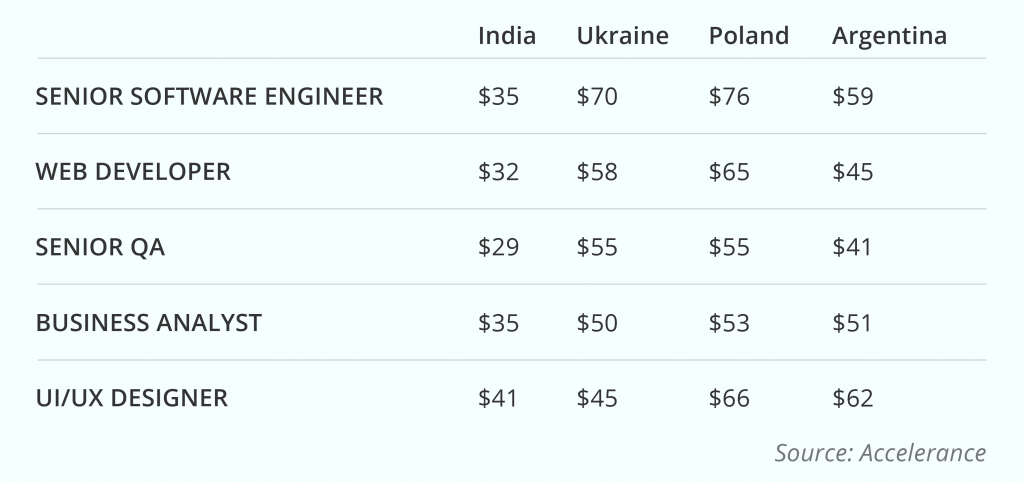

Moreover, the development cost depends on the country where services are offered and the development company rate. Take a look at the average rates of IT specialists from different countries and compare their hourly rates.

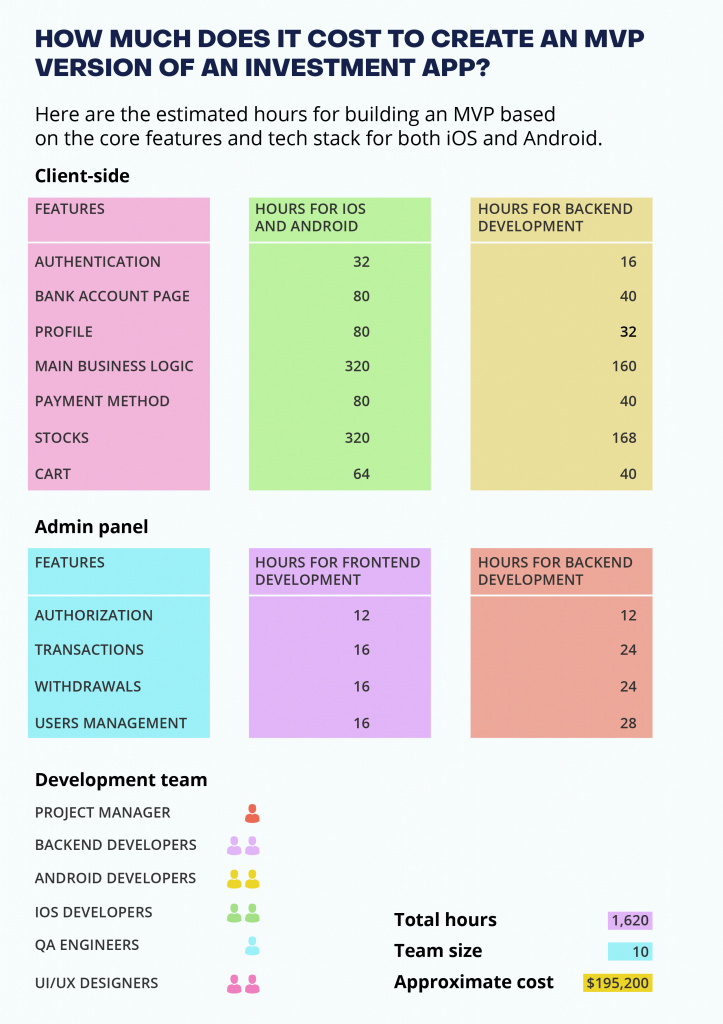

To give you a general idea of how the app costs are estimated, let’s take a look at the example below. We show you how much it might cost to build an MVP version of a native investment app. We consider only the main features to roughly calculate how much the app development will cost.

Note: This is only an approximate example of cost. Prices are calculated individually depending on the type of your fintech application, whether it’s a development from scratch or an old version update, what development approach you need, the technologies required, and many more factors.

We’ve considered the approximate cost of developing an investment application. But remember that the amount depends on your requirements and the specifics of the project.

Do you need fintech app development cost estimation? Share your fintech idea with us and our experts will calculate your app development costs.

Next, we want to share some valuable things to consider when developing a mobile financial app.

Our recommendations for building a successful fintech app

You’ll want to bear in mind some essential items to successfully create a fintech app and acquire the maximum number of users. Here’s a short overview of what you should consider when you start your fintech app development.

Start with a product discovery phase

First and foremost, it’s crucial to verify the viability of your fintech idea, and a product discovery stage is suitable for this purpose. For example, at Alternative-spaces we conduct this phase to ensure our clients have a feasible product idea, define project complexity to assess the total cost, and evaluate possible risks. This stage allows you and your development team to organize smooth and timely product development and stay on the page with all stakeholders.

Find your niche and meet its needs

It’s best not to rush when starting the development process. Instead, first decide on the fintech area you’re going to focus on (digital banking, insuretech, loan lending, etc.) and then research the market and identify your target audience needs. Pay attention to what pain points your target market has and try to solve them by providing an improved product that contains useful features and an intuitive design. You can also get demographics like age, gender, location, etc. that allows you to build your marketing campaign more effectively.

Focus on the user experience: try on the user’s shoes

As a rule, financial applications provide complicated services; thus simplicity, transparency, and intuitive design are a must for your tech solution. Here are some practical tips that help achieve results:

- Onboarding. You can show users videos to demonstrate the benefits of your app and how it solves users’ pain points. Or provide valuable tips that navigate users through the app to get to know core features. These activities improve users’ experience and engage them since you show your care from the first screens.

- Everything’s at hand. Ensure all necessary components are available on the dashboard. This will allow users to quickly solve their problems without a long search for the desired element.

- Engaging and modern UI. First impressions are everything. You have only a few seconds to impress users and engage them to use your app. Use a vivid color palette to strengthen the UX, add gradients to outline the shapes of design elements, and apply easily readable fonts. And remember that all design elements like typography, icons, buttons should match your corporate style and brand.

- Don’t display too much information. Avoid long blocks of text with hard-to-read information. Visualize and simplify data for transparency and ease of use with the help of video or practical and appealing animations.

- Add personalization. Users have different needs and goals. However, understanding their needs and wants allows for providing a personalized experience. Personalization is a great way to make your product unique and provide users with relevant experiences. For example, many fintech apps collect data to market products to the right users according to their preferences. The more individualization you provide, the more likely users continue using your fintech app.

Ensure a high level of security

Security is paramount, especially in the fintech industry, as it utilizes users’ private data. If one security issue happens, your reputation can be ruined and you risk losing your customers. Below we consider best practices to ensure high-level security:

- Encrypt data. Encryption implies mathematical algorithms that encode data into code. Unauthorized users or hackers can’t decode this data without a specific decryption key. There are such popular encryption algorithms as Twofish, AES, RSA.

- Provide secure authentication and authorization. Your security measures during authentication should not be limited to SMS passwords only. Integrate multiple technologies to maximize the security level of your app. For example, you can use two-factor authentication with voice, face, and fingerprint recognition. Also, you can require users to reset their passwords regularly, for example, every three months. If a user enters the password incorrectly after the third attempt, you can block the account to avoid account hacking, information leakage, and loss of money.

- Ensure secure app logic. To avoid any possible threats, it’s better to establish security measures at every stage of app usage. You should monitor unusual activity to identify hacking and information leakage. One more way to protect your fintech app is to establish a One-Time Password system. OTP allows generating a unique and limited-time password that can be used only once.

- Tokenize data. Tokenization is a great way to store and transfer data securely. Using this technology, you can replace private data with a random line of symbols, namely tokens. To decrypt essential data, it requires unique databases called token vaults.

- Test regularly and often. It’s crucial to test your app security at every stage of the development process. Your QA team should test every corner of the fintech app to ensure a high level of protection. Usually, QA engineers run penetration tests to simulate attacks for detecting all security flaws and vulnerabilities.

Final thoughts

Nowadays, fintech has become a crucial part of our daily routines, and we can no longer imagine our lives without these technologies. It may seem that developing your fintech app is a challenging task that takes much time and effort. You should clearly define your project’s goals and requirements, decide on features and tech stack, and ensure legal compliance. However, your development process will be smooth and seamless with the right approach and the experienced fintech team.

Indeed, building a fintech app is a complex process that entails deep research and great experts. At Alternative-spaces, we have a great deal of fintech experience to share. Our experts provide various fintech app development services, and we have expertise in creating fintech solutions of different types: from crypto projects to micro-investing apps.

To create a viable fintech product, our specialists can build MVP first to validate your business idea, ensure high product quality, and provide a catchy and intuitive design product. Moreover, we fully realize that your application should be unique in order to stand out. We can add unique functionality to your product by integrating such innovative technologies as blockchain, AI, VR, and machine learning.

If you want to create a fintech app that’s enhanced with modern and innovative technologies, drop us a line, and our team will analyze your business idea and provide you with a more detailed estimate.

Content created by our partner, Onix-systems.

Home

Home