How to Build a Personal Finance App like Mint: Useful Tips

This article will show you how to build a personal finance app like Mint from scratch. We provide practical strategies, talk about the technical side, share our real-life experience.

Today mobile personal finance apps have taken the world by storm and are here to stay. COVID-19 has triggered a boom in budgeting apps since, during lockdown conditions, more and more people use smartphones to manage their bank accounts, credit cards, investments, income, and so on.

Moreover, the global personal finance software market was valued at $1,024.35 million in 2019 and is expected to reach $1,576.86 million by 2027. So, as you can see, building a budgeting app is a promising idea in today’s business climate. However, to create a budget management app like Mint, it’s crucial to know the rules of the fintech market and the possible challenges.

Let’s start with a brief overview of the Mint concept.

What’s Mint?

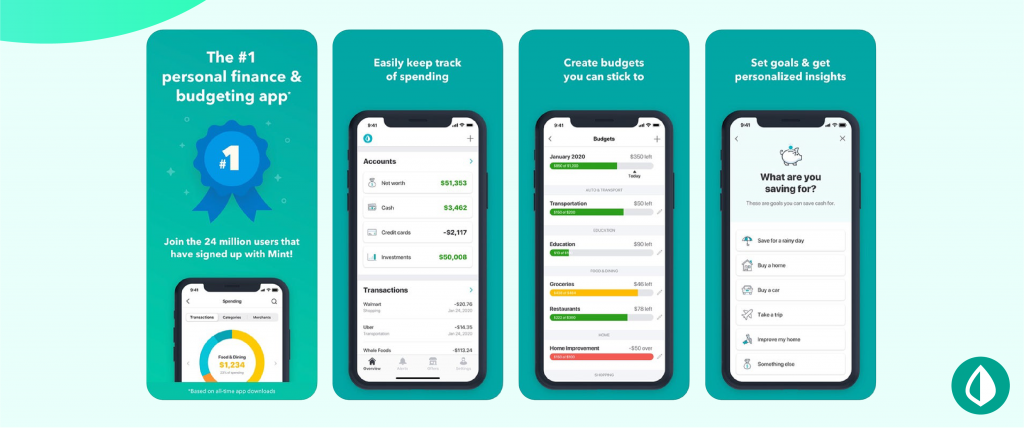

Mint is a free personal financial management app that has a variety of easy-to-use financial planning and tracking tools so that users can automate their budgeting process and save money.

Mint allows its users to connect all of their financial accounts in the app and get a clear picture of their financial situation. Users can categorize their transactions into budget categories, set budget goals, and track their spending and savings. Moreover, Mint sends users notifications to pay monthly bills.

If you have an idea to build a custom budget planner app like Mint, you should start your journey by considering this list of essential features that a modern fintech app can’t survive without.

What are the core features of a budgeting app like Mint?

In this section, we present features in personal finance apps that are fundamental to apps of this type and will help you discover how to build a budget app like Mint.

Registration and account creation

To start using a budgeting app, users have to sign up and enter their personal data. After registering, users can create their accounts and start tracking their spendings. Pay close attention to authorization and security. You can implement two-factor authentication, fingerprint or voice recognition, and unique code generation. For example, at Alternative-spaces, using a third-party SDK, we check the validity of documents and match the user’s selfie with the photo in their passport.

Synchronization

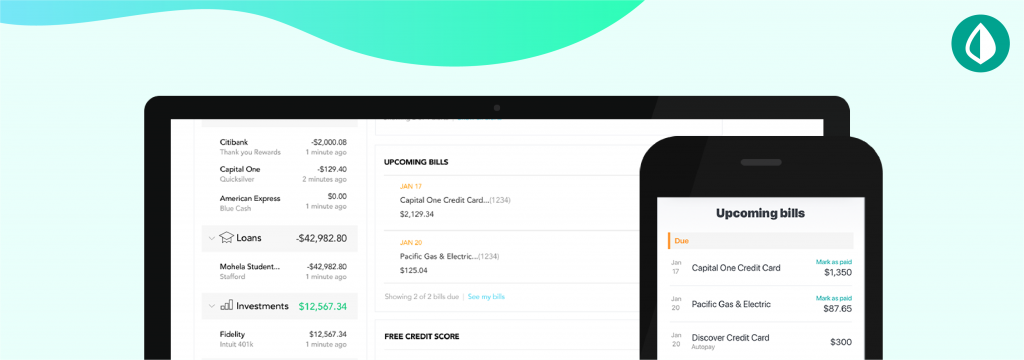

Users of a budgeting app will want to synchronize all their accounts such as credit and debit cards, investments, loans, and so on. Synchronization allows users to view the information and data of all accounts in one digital place and keep track of their budgets effectively.

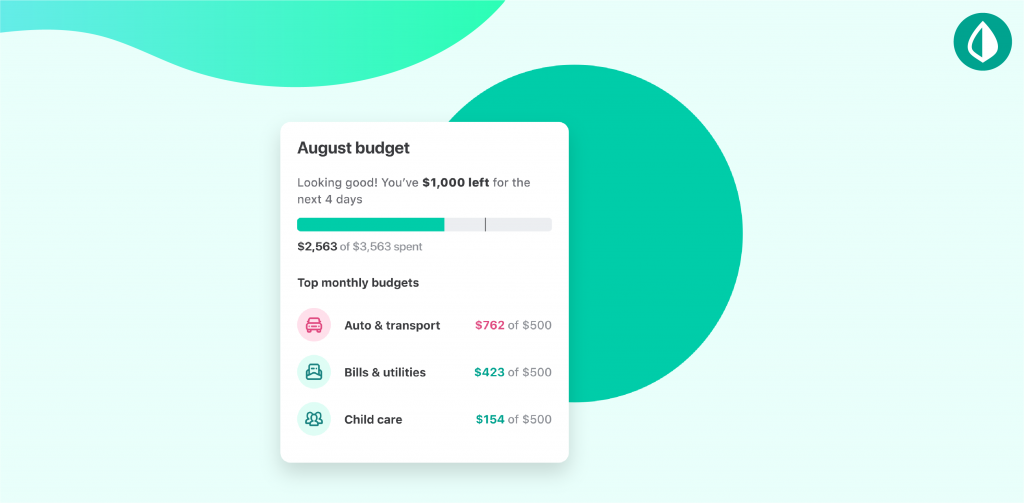

Budgeting and expense categorization

You should provide a budgeting option for users to plan their spending for a week, a month, or several months. Let your users set spending limits, and the app will notify them before overspending. One more super feature is to show your users what exactly they spend their money on. A budgeting app can provide categories for expenses and automatically categorize users’ transactions to track their spending effectively.

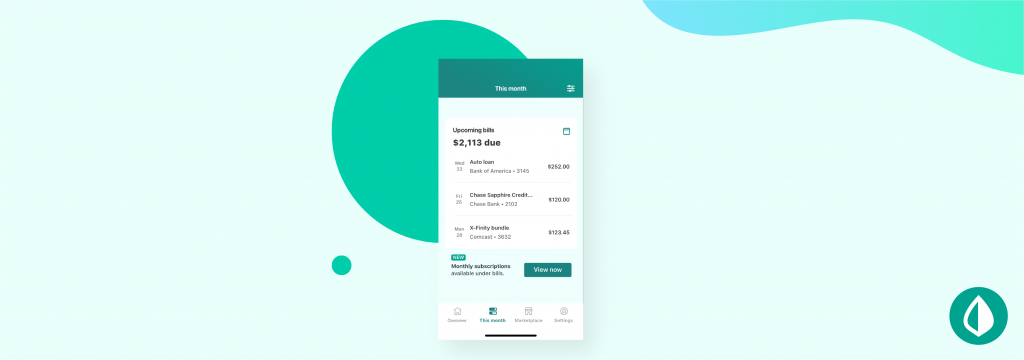

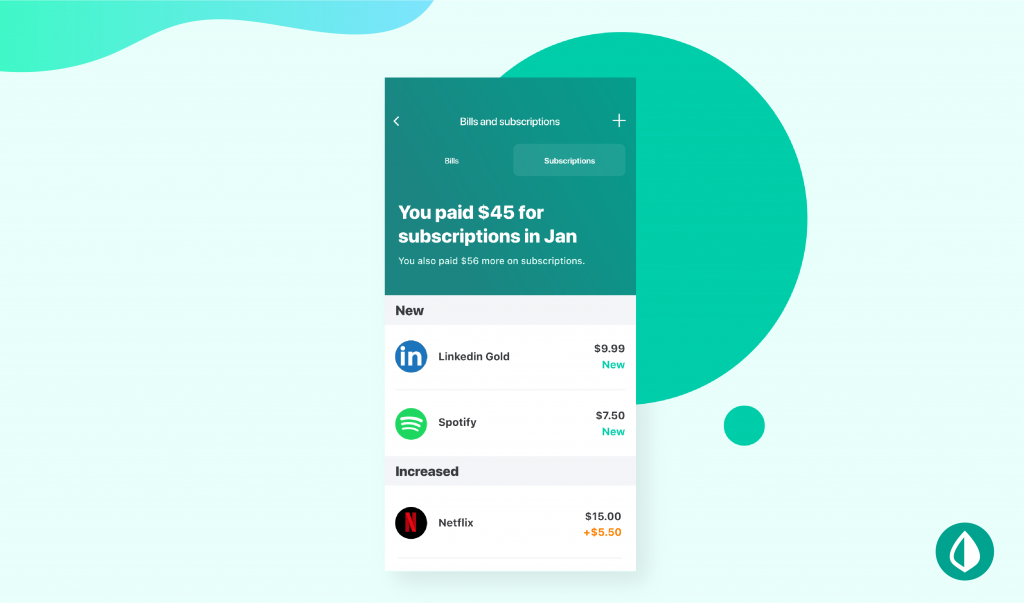

Bills and subscriptions

This feature allows users to keep their bills in one place. A personal finance app can track due dates and notify users of what and when they should pay. Thus, users never miss a payment and always stay in charge.

Notifications

This feature is a must for a personal budget app to keep users on top of low balances in their accounts, goal milestones, upcoming bills, late fees, suspicious operations, etc.

Customer support & consultation

Users may encounter technical issues, so you should provide 24/7 support for

Analytics and reports

Using this feature, users can keep track of their financial activities to manage and save their money properly. Thanks to well-organized data, users can get daily, weekly, monthly, and yearly reports to see income, expenses by categories, summaries of payees, forecasts, and so on.

Gamification

For a mobile app like Mint, gamification is essential. Gamification involves adding game-like elements to a budgeting app to encourage engagement. You can add elements such as a points system, clear goals, rewards, and achievements to keep users involved, allowing them to accomplish their saving objectives better.

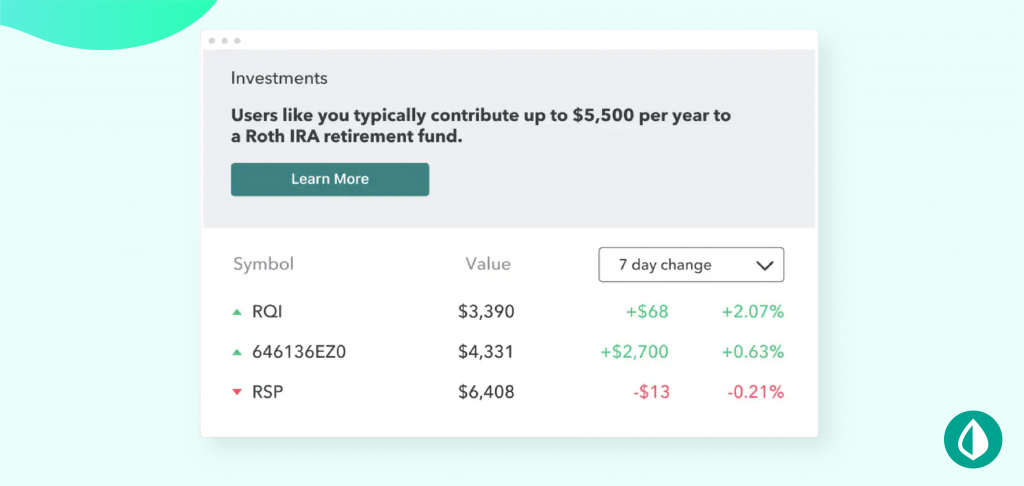

Investment tracking

This feature allows your users to track where expenses go and where to invest their money. An investment tracker can help users stay on top of market benchmarks and monitor all their asset allocation such as brokerage accounts, real estate investments, mutual funds, IRA investments, etc.

Artificial Intelligence

This technology allows you to significantly personalize your finance app and be ahead of the competition. Using AI, you can provide your customers with AI-driven financial coaching that analyzes users’ data to offer suggestions and recommendations and effectively regulate their expenses to reach goals. Furthermore, AI technology can automatically categorize expenses and show a holistic picture of which category users spent more money on.

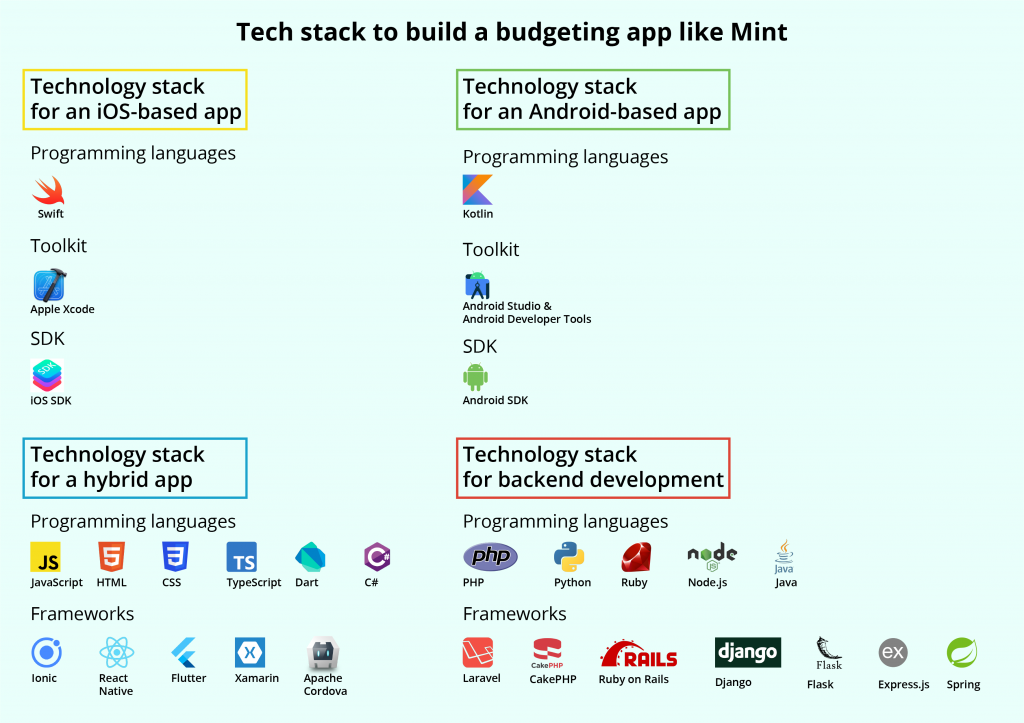

What technologies are required to create a personal budget app like Mint?

Now that we’ve identified the needed functionality let’s look at the required technologies and tools that will dictate the basic cost of developing a budgeting app. Below you can see a table that provides a tech stack recommended by our experts to use for personal finance app development.

How do personal finance apps like Mint make money?

You might be wondering why Mint is doing so well in such a competitive environment. It’s mainly due to its effective revenue strategy. Let’s dig deeper to see the main ways of monetizing a budgeting app.

Freemium. This is a prevalent monetization method that offers a basic set of app features for free, while extra features are for sale. For example, you can charge users for personalized guides, money-saving tips, etc.

Credit monitoring service. Mint offers basic credit reporting for free. Still, it provides users with premium reporting service Mint Credit Monitor for $16.99 per month. Using this feature, people can keep an eye on their financial health and receive credit reports from all three credit reporting agencies along with an Equifax Risk score.

In-app ads. This is the bread and butter of many mobile apps. In 2020, mobile advertising spending reached $223 billion and is expected to reach $339 billion by 2023. The main idea of this monetization method is to receive payments by showing users third-party ads based on their transaction history. The ad can be in various formats such as banners, native ads, full-screen ads, or video. Plus, users can pay to stop seeing any ads.

Subscriptions. Applying this monetization strategy means your users will pay a monthly fee to use all app’s features.

Selling aggregated financial data. You can generate revenue through aggregating financial data relating to consumer trends and then selling it to third parties for promotional, research, and marketing purposes. Many apps employ this strategy including Mint.

Paid app. This method of monetization implies purchasing your app just once and providing users with all its features.

Referral fees. You make money when users buy the financial items your app promotes. For example, Mint promotes services and products like credit cards, insurance, loans, and many more. Anytime customers take Mint’s advice, the app receives a referral payment.

How much does it cost to build a personal finance planner app like Mint?

The cost of mobile app development is comprised of various factors such as:

- Number of needed features

- The complexity of the project

- The platform you’re opting for (iOS, Android)

- Mobile app development approach (native, web app, hybrid)

- Selected technologies (languages, libraries, frameworks, Blockchain, AI, VR, etc.)

- Mobile app design

- Team size (project manager, UI/UX designer, backend developer, frontend developer, QA engineer, DevOps, and so on)

- Cooperation model (outsource, freelance, in-house team)

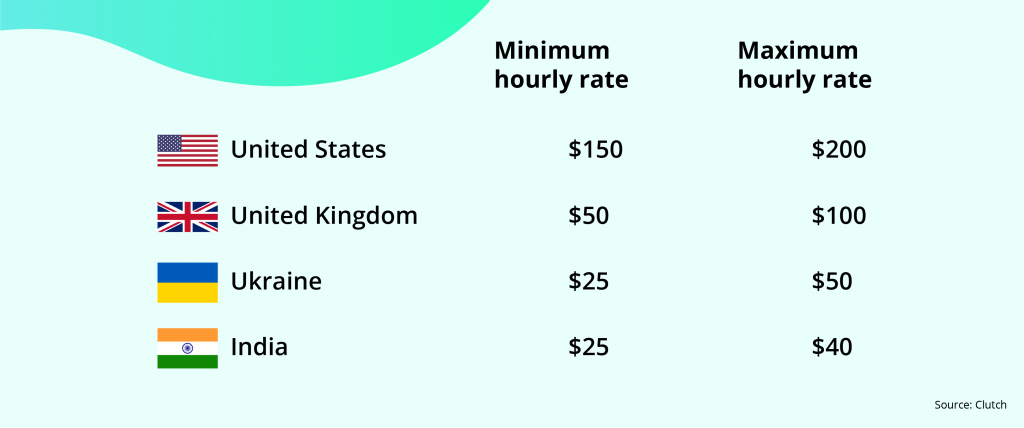

However, the most important factor that has a significant impact on the development cost is the company rate. Depending on the country where the tech company is located, the development services rates may vary. Just see the picture below to compare the average rates of IT specialists from different countries.

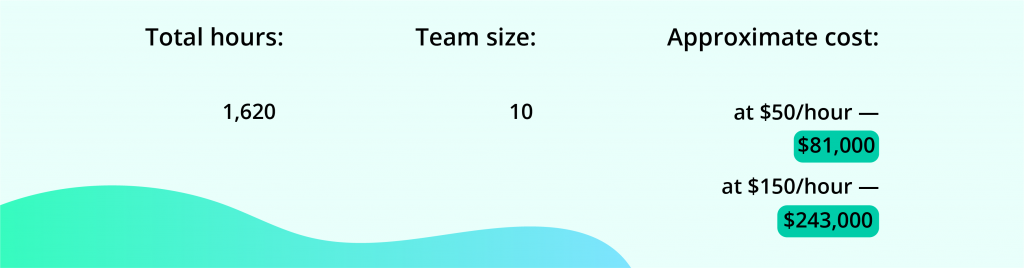

The approximate time to build an MVP version of a native budgeting app is 1,620 hours. And, to create a finance planner app, you’ll need a development team that consists of the following specialists:

- Project manager 1

- Backend developers 2

- Android developers 2

- iOS developers 2

- QA engineers 1

- UI/UX designers 1

It’s worth mentioning that the team size may vary depending on the project’s complexity, the number of features, and required expertise.

Now that we know the underlying factors, we can move on to the development cost. We use the following formula to roughly calculate personal finance app development cost: app development time X hourly rate.

Note: This is only an approximate example of cost. To calculate the final price, we need to know your project requirements, its complexity, the needed technologies, and many more determinants.

If you want to know the exact cost to make a budgeting app, discuss your app idea with our experts, and we’ll calculate your app development costs.

Our recommendations for developing a successful personal finance app like Mint

We’ve considered all the development details. Next, we would like to share some useful tips that will help you create a successful product like a Mint, or even better. You will want to bear in mind the following:

Verifying product viability

Building a great product requires a solid foundation. So before jumping into coding and designing, it’s vital to uncover the underlying users’ needs and how your product’s functionality is going to solve them. Here is where a discovery phase comes in handy.

At Alternative-spaces, first and foremost, we conduct a product discovery stage that allows us to analyze the business idea, gather requirements and define project complexity, test the market viability and minimize development risks. To find more about this stage, please, check out the link below.

Security measures and compliance with legal requirements

Despite the fact that developers carefully think out and implement the app security at the development stage, we would like to pay particular attention to it. Security is a top priority of any product, especially a fintech one. Don’t risk users’ private data and your reputation, but rather take reliable protective measures.

There are various best practices to ensure a high level of security. Among them are:

- Data encryption to encode sensitive data into code that prevents any frauds

- Session mode to offer short-duration sessions or cut off inactive sessions

- Two-factor authentication via fingerprint, face integration, voice recognition, or a password for one-time use

- Data tokenization to use a random line of symbols that replace sensitive data

- Conducting regular testing to catch all security flaws and vulnerabilities

In addition, bear in mind the legal compliances of the country where your app will run and be sure you meet all regulations. The most common compliances you may faceare: anti-money laundering (AML), securities and exchange commission (SEC), electronic fund transfer act (EFTA), electronic identification and trust services (eIDAS), fintech action plan (FAP), and many more.

We have vast experience in fintech development, and our experts can guarantee a proper meeting of your local legal compliances.

Focusing on the user experience

A personal finance application contains complex functionality. And here, it’s very critical not to make it more complicated. Users of these app types, as a rule, face finance management problems, so they expect to solve them quickly and easily using your app, namely with intuitive and convenient UI/UX design. Here are some valuable tips from our experts:

- Before designing an app, analyze your potential users’ needs and pain points to avoid spending money on something your users don’t want.

- Try walking in your user’s shoes to start thinking as they do and not design something they simply don’t understand how to use.

- Provide onboarding with valuable tips to educate users on how to use your features that solve their needs. These clues can significantly enhance your users’ experience and involve them from the very first screen.

- Do your best to find a middle ground and include all necessary features on the dashboard while not overwhelming the app.

- Remember about the golden rule “three taps,” which means users should be able to solve their problems / take the desired action in three taps or less.

- Replace large blocks of text with visualization, for example, appealing animations; try to avoid hard-to-read information.

Alternative-spaces is your reliable fintech partner

Alternative-spaces has 20+ years of experience designing and building fintech products including personal finance apps, crypto projects, micro-investing apps, and so on.

To validate your business idea, we can start with an MVP first. We analyze your target audience, gather requirements, conduct business analysis, choose solid technologies, and properly plan your project. These steps allow us to ensure high product quality and deliver a project on time and within budget.

So if you’re looking for budgeting app developers, look no further! We can form a dedicated software development team that assists you in building a high-quality budgeting app and achieving great results.

Please don’t hesitate to contact us. Together we can make a personal finance app like Mint, or even better!

Content created by our partner, Onix-systems.

Home

Home