A Short Guide to Micro-Investment App Development

There was a time when stock trading required education, brokers, agents, and deep pockets. Micro-investing supported by information technology removed these barriers. Nowadays, mobile phone owners, including younger generations, can invest tiny and irregular amounts, purchase fractional shares, and make money off existing savings away from traditional banks and brokerages.

It is mobile apps like Robinhood, launched in 2013, that have democratized the market; their audiences have been growing at a dramatic pace ever since. The recent pandemic has motivated people to seek alternative income, and since it isn’t the best time for playing big, micro-investments are all the rage.

Where there’s a market rush, there’s an opportunity to create an investment app. Millennials are reportedly ready to invest, whereas almost half of their income stays in checking and savings accounts. The crowd-investing market is expected to reach USD $7 billion in transaction value by 2022. The investment industry still offers an ocean of opportunities to introduce user-friendly features and innovative solutions.

This article aims to answer the essential questions: how do these apps work and generate revenue, how to create an investing app step by step, and how much it may cost.

How Micro Investing Mobile Apps Work

Novice investors rarely have much money to start. Micro-investing apps solve this dilemma by connecting to a user’s debit card and rounding up their purchases. For example, a user’s iced coffee price of $3.75 will be rounded up to $4. The extra quarter will be transferred to their investing account and funneled into a chosen portfolio of stocks.

The apps typically keep the amounts necessary for opening an account and investing at the minimum. The same for fees and commissions, if any.

Micro-investing apps offer a “set it and forget it” approach to continuous investing. The users typically buy exchange-traded funds (ETFs), virtually purchasing shares in dozens or even hundreds of companies. As a result, they don’t have to closely follow the stock market, watch CNBC, or read The Wall Street Journal.

All of this makes micro-investing apps great for:

- new investors, especially millennials

- people with limited money to invest

- people reluctant to pay investment fees

- Investors looking to automate their investing

- those who want to develop strong saving and investing habits

If you are interested in micro investing platform development, it’s essential to study the leaders’ products. You may discover opportunities and features worth incorporating into your solution.

Leading Micro-Investing Apps in the US

Acorns

Founded in 2012, Acorns is one of the micro-investing pioneers. In 2015, the platform extended to Australia, and in 2018, Acorns Australia rebranded as Raiz Invest.

Designed primarily for millennials, Acorns offers users two ways to start investing easily:

- link their bank account and opt for automatic monthly deposits;

- either have the app automatically round up all purchases with linked debit or credit cards or manually round up only chosen transactions.

Acorns also partners with hundreds of retailers so that the cashback can be reinvested automatically.

Users don’t have to choose exactly where to invest. When their profile is created, they answer several questions and state their goals. Based on their age, risk tolerance, and income, the system compiles their investment portfolio from different stocks and bonds, ranging from conservative to aggressive.

Only $5 is required to open an account. There are three tiers of monthly portfolio management fees:

- $1 per month for standard Acorns Core

- $2 per month for Acorns Later with IRA accounts and add-on features

- $3 per month for Acorns Later + Spend with all extra features and a checking account

Acorns will waive the fee if the balance is zero, but once it exceeds $5,000, they will collect 0.25% of the balance per year.

Acorns generated $71 million in revenue in 2020 and expects to earn $126 million this year. The company is currently valued at $2.2 billion.

Robinhood

Unlike Acorns and Stash, Robinhood allows users to trade full stocks, options, and cryptocurrency. Robinhood doesn’t advise users on their portfolio, but they can see the average share price investors bought stocks at and their current prices, related stocks bought by other investors, stock ratings by analysts, earnings information, and general stock market news.

There are no account maintenance fees. The premium service, Robinhood Gold, for $5/month also enables users to borrow money to buy stocks. (If you wish to build an investment app similar to Robinhood, you can find more information about its revenue model, features, and design in our recent article.)

Last year, Robinhood’s revenue approached $959 million, up 245% from 2019. In July 2021, the company’s shares started trading, selling 55 million shares in its company via an initial public offering on the first day raising $2.1 billion. Currently, it is valued at $32 billion.

Stash

Founded in 2015, Stash is the youngest player on our mini-list. Also allowing investing with just $5 without any trading fees or commissions, Stash is differentiated by the greater flexibility and control users have over their investments.

User accounts fall into three categories: conservative, moderate, and aggressive risk profiles. Stash advises users to read their investors’ guide before making any decisions. Theoretically, 3,000+ stocks and ETFs are available, but Stash uses preliminary surveys to curate and categorize the most suitable assets for each user. They can decide in which services, products, causes, and companies to invest: software development, legal cannabis farms, or whatever aligns with their beliefs, interests, and goals. Users can read more about each company and assess their risk level.

Users can connect the app with their bank account and specify the amounts to withdraw weekly or monthly to invest in their portfolio, which they can check and modify as often as they like.

Stash offers three plans:

- For $1 per month, customers get a personal brokerage account and access to banking services.

- For $3/month, Stash adds a retirement account.

- $9 monthly covers additionally two custodial investment accounts for kids, a STASH Debit Card with 2x Stock-Back™ rewards, and monthly market insight reports.

Stash saw record growth in 2020. Now, with over 5M customers and $2.5 billion in assets under management, its valuation is estimated at $1.4 billion.

It’s super important to understand the competitors’ monetization strategies and alternatives: it should help you in developing your own.

Monetization Strategies of Micro-Investing Mobile Apps

Four monetization methods are popular with micro-investing apps currently:

Advertising

Digital advertising is easy to set up and implement, but too much advertising, especially irrelevant ads, can negatively affect your app experience and thus usage, engagement, and customer retention — all critical metrics for a startup.

Premium subscriptions

You may charge customers monthly or annually, possibly for using different services as Stash does. It’s highly recommended to offer a free trial period, which can range from weeks to months. Having fully appreciated the app and being hooked on it, people would opt for a paid subscription eagerly.

Freemium

This approach implies that users can enjoy most of an app’s functionality for free and pay for premium features if they want more. For instance, once your users have developed a taste for investing, you can allow trading on margin like Robinhood or offer features that promote better-informed buying decisions.

Affiliate programs

The commissions from affiliate programs are suitable as additional income. It’s advisable to select the hottest products among the suggested and look for relevant businesses your mobile investment app can promote.

Most micro-investment apps employ hybrid monetization models including specialized methods. For example, they may charge:

- asset management fees as a percentage of all transactions conducted through their investment system

- fees for depositing and withdrawing funds

- interest on margin usage

- fees for additional services, such as issuing various documents, consultations with expert traders, portfolio audits, access to market studies, statistics, and so forth

- fees for directing the users’ equity and options orders to market makers

The components of your future revenue model will depend on what services your micro investment platform offers. It’s time to talk about its features.

Basic Steps to Create an Investment App

1. Research and ideation

It’s recommended to engage a financial planner, lawyer, business analyst, and other experts right at this stage.

You will need to study, analyze, and evaluate:

- The niche: the number of competitors, development potential, promising markets, trends in investing, etc.

- Your potential competitors: their userbases, financial indicators, business strategies, unique selling points, pricing, etc.

- Rival apps’ strengths and weaknesses, such as their portfolios and available ETFs, mutual funds, cryptocurrency, and other assets, user-friendliness, visual design, level of service, reviews, and more

- Your target audience’s age, income, family status, geography, profession, education, experience, habits, preferences, needs, requirements, inhibitions, pain points, and possible solutions

- The banking services you want to have and the risks you are prepared to take

- Local and international regulations regarding consumer data protection, fintech security, and digital financial activities

This research will help you find a niche, devise a unique selling proposition, figure out the future app’s must-have and nice-to-have features and ways to monetize them, and decide on the primary OS or both.

It’s advisable to plan your business pattern early: portfolio variety, the ETFs you want to use, minimum account balance, fees, commissions, plans, discounts, etc.

NB. Along with the technical challenges of fintech investing app development, be prepared to face significantly challenging organizational issues such as:

- making agreements with third-party services and payment systems, followed by a technically difficult integration;

- making arrangements with banks to get financial information about users;

- preparing test accounts with connected bank cards so that the developers can test payments through the system they build;

- undergoing a financial audit and getting the go-ahead to launch the application.

2. Select your app’s features

It will be most reasonable and cost-effective to build a micro investing app’s basic version first. A minimum viable product lets startups validate the idea, assess the demand, and receive user feedback early. If the response is negative, you will be able to pivot quickly or close the project without losing much money. If positive, you can continue, enhancing and adding functionalities.

The MVP is limited to the features that satisfy the users’ primary needs and help differentiate it from the competition. The following are considered essential to investment app development:

- Registration and login. It’s recommended to offer several simple, fast, but secure ways to register and log in. For example, the simplest way to add security to an email+password or phone number+password signup is to enable iPhones’ face ID and touch ID or their Android counterparts. It’s advisable that the app should log out the user when it’s in the background mode. To make it more user-friendly, you can implement a pin code feature: after a successful first login, the user would need to enter only a 4-digit code instead of all the credentials every time the app closes.

- Bank account linking. Users need the ability to select their bank accounts and debit and credit cards they wish to connect with the app. Once a person has registered and filled in the necessary forms, the bank would receive the information and provide their credit score and reliability required for investment suggestions.

- Personal profile. In this app section, users can enter and manage personal and bank information, set the amounts to deposit and withdraw, turn round-ups on and off, build and adjust their investment portfolio, manage and track their investments and earnings, view their trading history, manage subscriptions, settings, and more.

- Homescreen. On a home screen or instant dashboard, users may wish to see their invested amount, whether their investments are growing, the assets they own, the money available on their investment account, and charts displaying preliminarily calculated profits over the years based on risks, investment amounts, and trading strategy.

- Favorites and discovery. This screen may offer analytics and grouping of stocks that are trending, most stable, etc. Provide the ability to add stocks to favorites and review later.

- Transactions management. Users need intuitive tools for selling and buying assets, including search and sorting other than by their symbol. You can display a line or candlestick chart for a given stock, information about the company, analyst ratings, and other stocks people often buy. Users can also set a stop-loss price to sell a stock automatically when it reaches a specified price.

- Notifications. Push notifications, personalized reminders, and real-time alerts can update users about specific asset price rises/falls, completion of a buy/sell order, returns on investments, special offers, promotions, suspicious account activity, and more. Enable users to customize the reasons for notifications and choose the time, frequency, and type of alerts: standard notifications, contextual pop-ups, text messages, voice prompts, and emails.

To stand out from the crowd of competitors, you need to include better features, innovations, and benefits right in the MVP. It may be helpful to develop some of the following:

- Analytics dashboards. The app may conveniently present to customers information they need for making buying decisions and daily, weekly, and monthly reports of their financial and investing operations.

- Market information. You may enable customers to read the latest market news, research reports, comparisons of companies’ financial performance, and more.

- Education. New users might appreciate a wiki, glossary, FAQs, tutorials, quizzes, blogs, videos, or even a trading simulator in the app.

- Robo-advisor. The simplest robo-advisors are algorithms that use customer surveys to determine their investing profile and suggest suitable options. A chatbot can provide a more advanced solution.

- Human advisors. You can match each customer with a personal trading advisor and facilitate communication between them through the app.

- Advanced money management tools. You may offer dashboards with instruments for currency, savings, and credit management.

- Customer support. The users’ ability to contact you 24/7 is key to improving your app, good reviews, and ultimately your brand. It’s best to offer several communication channels: comments and reviews section, chatbot for typical inquiries, live chat with a support team, email support, a callback option, or even round-the-clock access to financial consultants by phone.

Using these functional blocks or modules as foundations for paid features, you can create several versions of your app and offer free and paid subscriptions.

Here are some more ideas to reinforce your unique value proposition:

- cryptocurrency and other advanced trading options

- limit/stop/trailing stop orders

- saving and investing in multiple currencies

- dividend reinvestment

- retirement planner and account

- risk prevention

- tax wrapper and monitoring

- donations and charitable giving options

Remember that you also will need an admin panel for managing users and their actions.

Besides the lists and descriptions of the selected features, you need to describe how the app will perform tasks for the users. You may sketch the screens, develop the app’s maps, or even create a clickable prototype.

Having your research results and documented requirements, professional software developers will be able to suggest a technical solution and estimate the budget.

3. Engage a reliable tech team

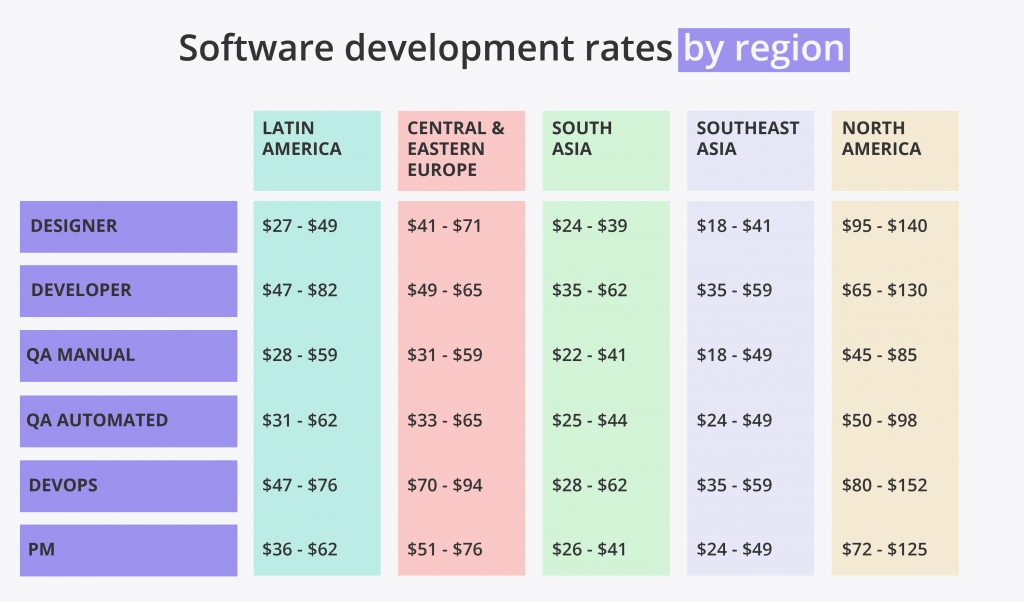

You can either recruit an in-house development team or delegate the job to a dedicated team located elsewhere. The latter approach offers several benefits significant to startups, but in any case, you will need to hire specialists to fill at least the following positions:

- User experience and user interface (UX & UI) design

- Front-end developers for iOS, Android, or both apps

- Back-end developers

- Quality assurance (QA)

- Post-launch support

- Project management (PM)

One advantage of dedicated teams is that you won’t have to search for, screen, interview, and hire each specialist. Your outsourcing partner will provide you with a whole team experienced in fintech investing app development and working well together.

Moreover, offshore outsourcing may help you save half of a project budget without compromising quality.

Once your mobile app has been released, got a user base, or even generated profit, an in-house team can safely take it over to maintain and improve under your watchful eye.

4. Address the safety and compliance issues in advance

Safety, security, and compliance with national and international financial industry regulations pose some of the greatest challenges to fintech investing app development.

For example, if you develop a mobile investing app for the European market, it has to comply with the General Data Protection Regulation (GDPR).

In the USA, broker-dealers are regulated by the SEC (Securities and Exchange Commission), the FINRA (Financial Industry Regulatory Authority), and other federal commissions, boards, and bureaus, as well as each state’s stock-broker regulations. The apps should also meet the Know Your Customer (KYC), Anti-Money Laundering (AML), and Customer Identification Programs (CIP) requirements.

Your app should also be protected against hacker attacks and data leakage.

You can find advice on building a secure fintech application here.

5. Create a user-friendly and appealing design

Your app’s design should not only address the general needs of mobile users, such as limited screen space, micro-interactions, glimpse views, etc., but make a mobile trading experience clear, delightful, and easy even for beginners.

The following tips should be helpful:

- create straightforward and consistent user flows and journeys

- prioritize simplicity over creativity

- focus on saving a user’s time

- the colors should communicate information and encourage desired actions

- adjust the layouts and graphics to various screen sizes and resolutions

It makes sense to offer advice to facilitate new users’ onboarding. Since stats and summaries often come in large table sheets, enable users to evenly scale large amounts of data and navigate through them on any screen. Consider supporting the landscape mode for charts.

Your design should also be memorable; the app’s icon and your company logo will be your calling cards. Polls, focus groups, and periodic A/B testing should be helpful.

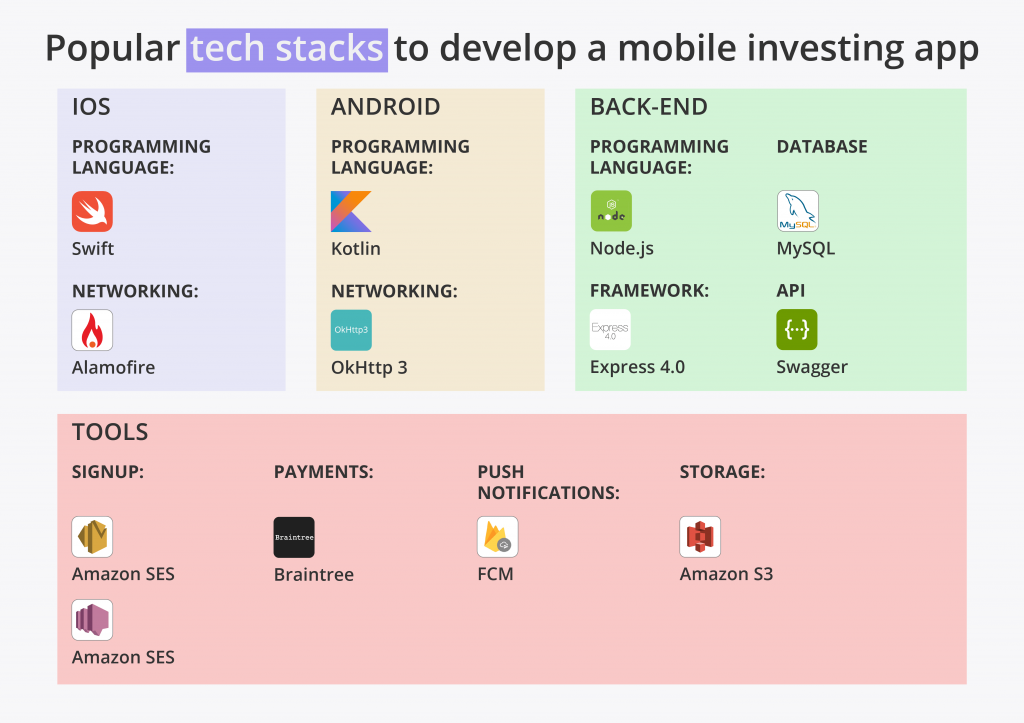

6. Pick suitable technologies

The technologies are selected and approved in consultation with the development team based on your project needs and requirements. The right tech stack will help ensure your app’s stability and scalability.

Numerous third-party APIs (Application Programming Interfaces) help implement specific functions and address technical issues associated with investment app development. For example:

- Plaid API provides the means for securely connecting bank accounts with fintech apps.

- Alpaca Stock Trading API takes care of the investment accounts and regulatory complexity.

- Some of the most popular APIs for tapping into real-time stock quotes, indices, commodities, and currencies, include Alpha Vantage, Bloomberg Market and Financial News, Xignite, Yahoo Finance, and Zirra.

- E*TRADE allows managing user account data, retrieving option chains, searching for exchanges, getting quotes, and managing orders.

- Finbox and Tradier, besides providing stock market feeds, offer stock metrics and research functionality.

7. Develop and test your app

At this stage, the developers will implement the required app functionality and design. QA engineers will continuously test the product to find bugs.

The team starts with building an investment platform. This back-end system works with stock exchanges and other services to populate the mobile app with data and aggregates stock market data, user transactions, and everything that happens in the app.

A modular structure is the most effective way to develop a mobile investing app. It’s recommended to divide the development process into sprints of two weeks and test the product at the end of every sprint, including user testing.

Stress testing is essential to ensuring system stability and seamless performance, without outages like Robinhood’s in 2020. To ensure error-free trades, the team can use tools like Sailfish, specifically designed for broker systems testing.

The product will also have to be optimized according to the standards and requirements of each app store you target.

8. Deploy and publish your investment app

After everything is tested and fixed, your app will be ready for launch on the App Store or Google Play. Usually, the dedicated development team helps upload the software to the mobile stores and hook it with the production server environment.

From now on, your team will have to:

- track KPIs and customer feedback

- update and improve your app with new features

- fix bugs introduced by updates in third-party APIs

- support the fresh features of the latest mobile OS versions

Estimated Cost of Investment App Development

A basic formula to calculate the cost of any mobile app development is:

Total app development cost = Development time x Cost per hour

Many factors determine the number of hours to deliver a product. For example, if you want the developers to create an investment app for you from scratch, the price will include the cost of research, business analysis, and prototyping, whereas homework may save you some cash.

Some other factors may include:

- types of the core and add-on app features

- development for iOS, Android, or both

- the development team’s experience and size

As a result, the minimum time to build an MVP for one mobile platform and an admin panel, with one part-time manager and part-time QA, may be estimated at 2,000 hours, whereas more complex solutions with fancy visuals would take twice as long to build or more.

Additionally, the developers’ hourly rates vary widely. Eastern Europe attracts many startups with optimal price/quality ratios. For example, a basic investment app may cost around $70K to build in Ukraine versus $130K+ in North America.

We know that startups may rely on lean budgets and need to calculate costs as accurately as possible before approaching investors. Why not schedule a free consultation to discuss your fintech investing app development needs or estimate a project?

Content created by our partner, Onix-systems.

Home

Home